In this Business & Money video tutorial you will learn how to read a balance sheet in accounting. Yu can learn to read it quickly and easily as to where the company’s came from, where it went and where it is now. There are four main financial statements; balance sheets, income statements, cash flow statements and statements of shareholder equity. In the balance sheet, under assets are listed things that the company owns that have value. Liabilities are amounts of money company owes to other...

In this video tutorial, viewers learn how to negotiate with a credit card company. There are 3 main items that users can negotiate. The first item is the date of payment. Users are able arrange a more convenient date for payment. The second item is the annual fee. Users are able to work out a way to not have to pay an annual fee for using a credit card, which will help save money. The third item is the interest rate. Users can negotiate and try to lower the interest rate that they must pay. T...

When someone you love asks for money it can be very hard to turn them down; especially since you are usually put on the spot. Check out this tutorial and discover ways that you can help your friend without having to spend a dime, and make things easier for everyone.

If you've ever wanted to know how to write checks in Intuit QuickBooks program, this instructional is for you. To write a check in the QuickBooks program: Select banking from the menu bar, and then the write checks command. Select the checking account for which the checks will be drawn from the checking accounts drop down menu. Assign the check a number if you will be printing the check. If you are printing the check, make sure that the "to be printed" box is checked. Enter the correct date f...

In this video tutorial the instructor shows how to derive the formula to compute interest compounded annually. He starts with explaining the basic concepts like principle which is the amount you borrow and the rate of interest or annual percentage rate (APR), which is the rate at which you pay the interest up on the borrowed principle. He shows that the amount after the end of one year is amount A = P(1+APR),and he goes on and generalizes how to compute it for n years. This video shows how to...

Looking to get an FHA loan? The Federal Housing Administration, FHA for short, provides mortgage insurance on loans made by FHA-approved lenders throughout the U.S. Here's how to get your FHA-insured loan. Learn how to get one with help from this video.

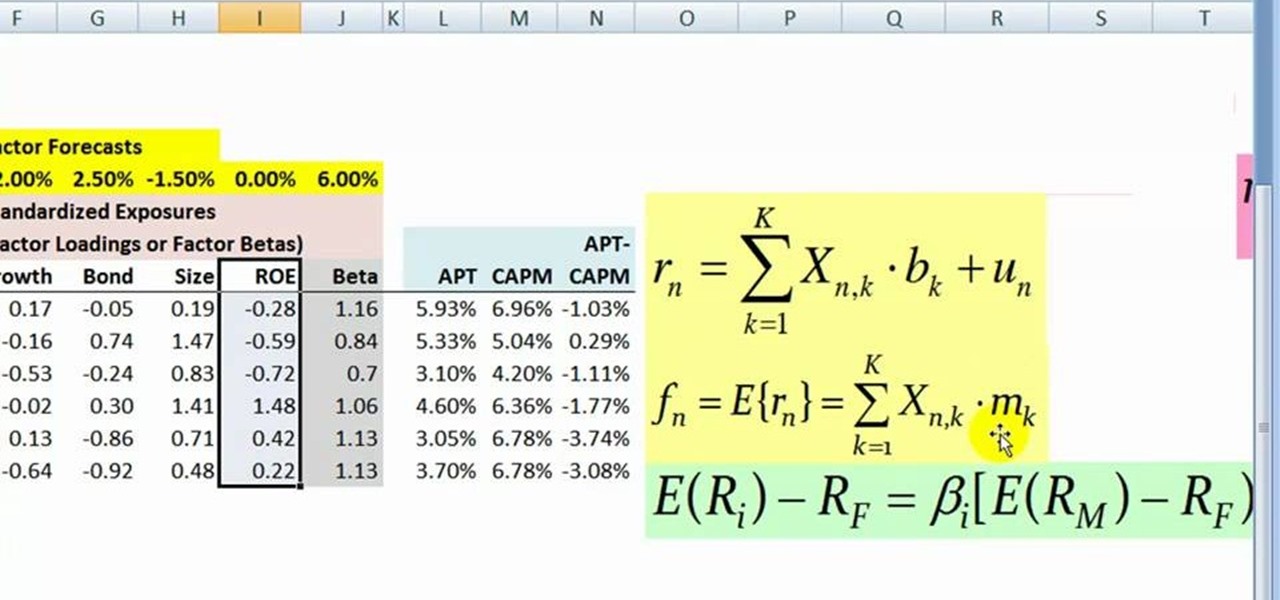

This video teaches you how to use APT (Arbitrage Pricing Theory) models and formulas. This video shows two specific parts of the APT models the first being the after the fact version and the before the fact version. The before the fact version is focused on as being the most important which is used to calculate expected returns to calculate risk. It is discussed how flexible this model is and how different factors can be moved in and out of the formula and how each different factor is used. T...

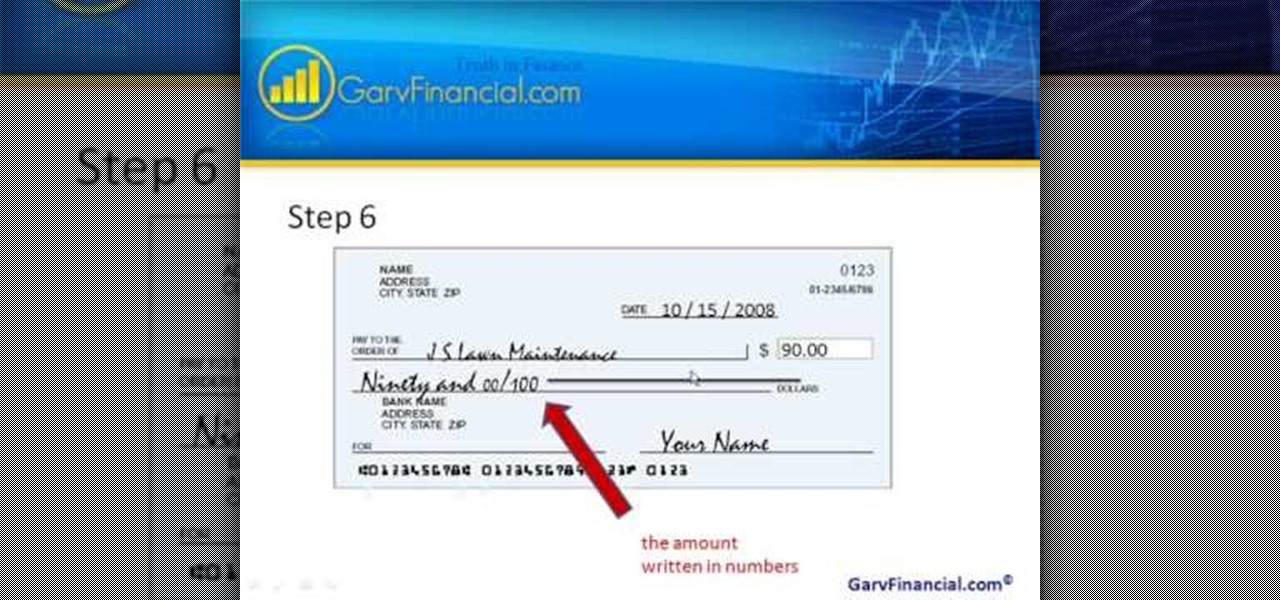

Here are step-by-step instructions on how to write a check. 1. Date the check, and ensure it is dated for the day you intend the recipient to cash it.

Horrible at saving money? Creating a savings account to put aside and accumulate money is easier with these strategies.

Looking to create a savings account? Once you see how much you can save when you spend only on needs rather than wants, you may never go back to frivolous shopping. In this video, ways to stop spending so much money are gone over.

Looking to cut your monthly expenses down? Brown-bagging is one of the easiest ways to save money, especially if you stock several key items. In this video, ways to pack a lunch for a dollar a day are gone over.

Need money fast but don't want to take out a loan? Asking a friend or family member for money is a sensitive undertaking. If you take the necessary steps, you’ll get what you need and ensure them that their money will be repaid.

Learning to write a check properly is something that everybody needs to learn. In this video, learn how to fill out checks correctly so that the bank and payee can clearly read them.

Just got piad? Turn your check into dollar bills by endorsing it at the bank. Don't know how? Watch this.

Woops! Make a mistake? Whether you’ve made a mistake, like writing the wrong year or wrong amount, or want to set up automatic bill payments or direct deposit, you may need to void a check. In this tutorial, learn how to properly void a check.

Usually those "dry clean only" tags mean one thing: dry cleaning bills. Why sacrifice wearing silk, suede, or other fine fabrics when knowing just a few clothes care tips can save you tons of money on dry cleaning.

Weird gifts from friends and family aren't the only things you can score on your birthday. With a little advance planning, you can get lots of freebies.

If your old clothes are of high quality and in good shape, selling them on consignment is an easy way to make cash quickly.

Not everything at the dollar store is a bargain, or even safe to use. Learn to spot the difference between an item that's cheap, and a cheap item.

Living within your means can be done. You don't want to be a slave to the credit card company, do you? Learn what to do to stay out of credit card debt. This how to video will give you the tips. Credit card debt is a slippery slope.

It’s never too late to clean up your credit record – and save yourself thousands of dollars in exorbitant interest rates in the process. Learn how to repair your credit with this guide from Howcast.

The key to repairing bad credit is to write a properly formatted letter of dispute to one or all of the credit bureaus and send them out via registered mail. Here's a step-by-step guide to writing a letter of dispute to get rid of those black marks off your credit report for good. Remember, it's your right to file a dispute.

An invisible number controls your financial destiny. So until the revolution, you might as well learn how to raise your credit score.

Cell phone contracts might seem iron-clad, but loopholes may let you get out of your plan without paying a dime.

There's nothing to fear about a trip to the mall—as long as you plan ahead and shop smart. This video demonstrates the best way to budget your money, make the most of your time at the mall, and shop smart, budget conscious. Good instructional video for your upcoming Christmas shopping & holiday sales.

Learn from those crazed coupon clippers who've figured out how to buy $500 worth of groceries for 50 cents. You will need Sunday newspapers, coupon websites, accordion folders to store the coupons in, and the store specific circular fliers. Watch this video budgeting tutorial and learn how to save money on food with coupons.

Expert money hider shows you where to hide money in your car, like: the back seat, glove box, trash, clothing, and cup holders in your car; find more hiding places in this free money hiding video.

Are you young, educated and broke? In this video tutorial, Better TV gives financial tips on how to survive a tight time after graduation.

In this tutorial, we learn how to improve your FICO credit score. Everyone will want to use your credit score to decide what kind of person you are. The FICO is the most commonly used credit score used today. To improve your credit score you will want to make all payments on time. Catch up on past due accounts and utilize 50% and less of your credit limit. Your balance should be under half of what your limit is. Don't close your account, because this can drop your credit score as well. Revolv...

Has you rent check bounced again for no apparent reason? It happens to everyone, but if you're roommate needs the money fast, you need to fix it fast, and wire transfers are the fastest way to give money to someone else. Executing a wire transfer is as easy as making one phone call.

Your first bank account can be exciting and confusing at the same time. Check out this video and learn how to manage your money and accounts so you don't wind up in the red. You don't have to earn an MBA to make good financial decisions; this video offers plenty of suggestions to keep your accounts on track.

This is video is a tutorial on how to save more money in your daily life. The video says that budget professional suggest that we need to set a goal. Decide why you're saving your money. Save your money to where if there were an emergency you could comfortably use your savings. The video suggests taking advantage of your employer's retirement fund. Last but certainly not least, we are told that saving sooner is better than saving later.

If you like to shop online then it is extremely helpful to have a PayPal account to safely make your online purchases. Help reduce your risk of identity theft by using protected methods like PayPal when your credit card information is involved.

Free Tax Help! Learn how to prepare and complete a W-4 for singles, married couples, multiple jobs, and more in this free video on explaining the W-4 tax form.

Americans spend up to 40 percent of their food money outside the home. Watch this instructional video to learn how you can extend your budget and save big money while dining out at restaurants from Stephanie Nelson of couponmom.com.

This video shows you how to write checks, in case you're really dumb. Two girls set up a fake store in which they demonstrate how to write a check. The girl playing the cashier explains the following steps to the other girl playing the customer.

American economy is based on credit in the form of credit cards, loans and debt management. Learn about credit and credit cards from a credit counselor in this free personal finance video series.

Bad credit? No credit? A good way to improve your personal credit score is by getting and maintaining a credit card. Get your first credit card and learn the basics of credit finance.

Ever since high school, I've been preparing my own taxes. Each year it gets more and more complicated, which results in me filing later and later, avoiding it until I have the time or just can't wait any longer. I even resorted to using TurboTax online to help do some of the grunt work for me these past couple years, but that hasn't stopped me from being lazy about it. I have yet to file my 2010 taxes, but I will very soon. Tomorrow, in fact—before TurboTax raises their prices.

It's mid-January and some of you happy tax-paying citizens have already started receiving your W-4s and 1099s in the mail. But before you start filling out your 2010 Federal Tax Return, make sure you're hip to all the tax tricks in 2011. You could end up saving some money!