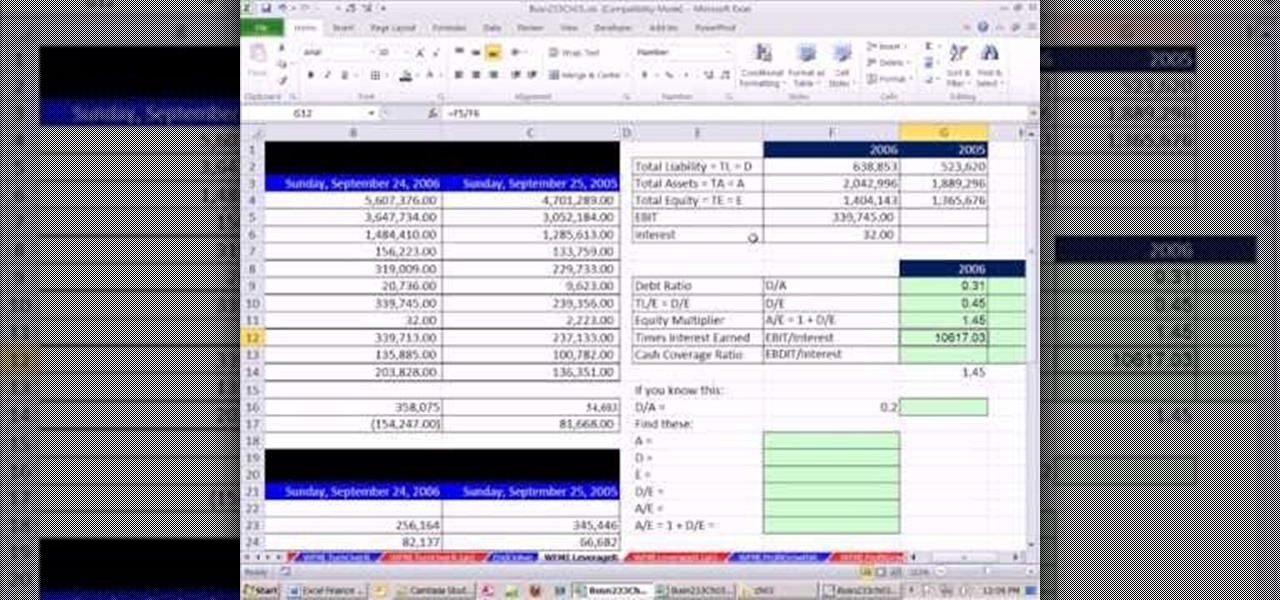

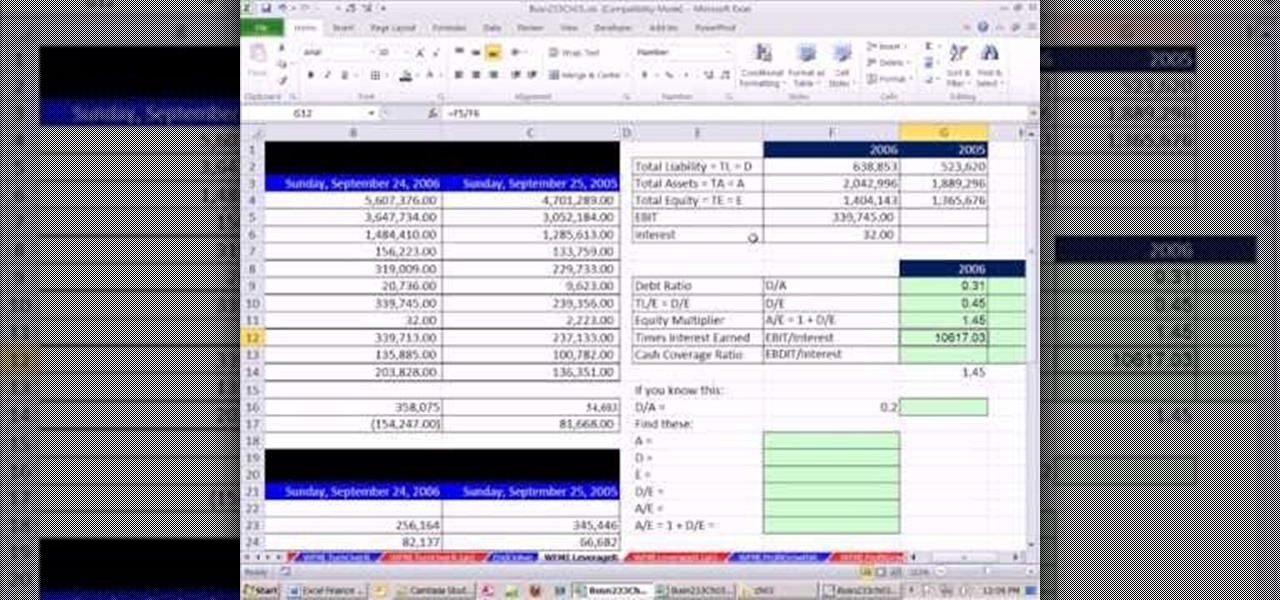

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 17th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate the debt ratio, debt to equity ratio, equity multiplier ratio and times interest earned ratio.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 19th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate return on equity, assets, and profitablility — return on investment (RoI).

In this Business & Money video tutorial you will learn how to read a balance sheet in accounting. Yu can learn to read it quickly and easily as to where the company’s came from, where it went and where it is now. There are four main financial statements; balance sheets, income statements, cash flow statements and statements of shareholder equity. In the balance sheet, under assets are listed things that the company owns that have value. Liabilities are amounts of money company owes to other...

Looking for fast cash with no questions asked? There are legitimate ways to get it, if you're willing to pay the consequences. You will need a credit card with unused credit, a tax refund, a car, a small loan company, a signature loan company, or a payday loan. Watch this video tutorial and learn how to get money quickly by finding a loan shark.

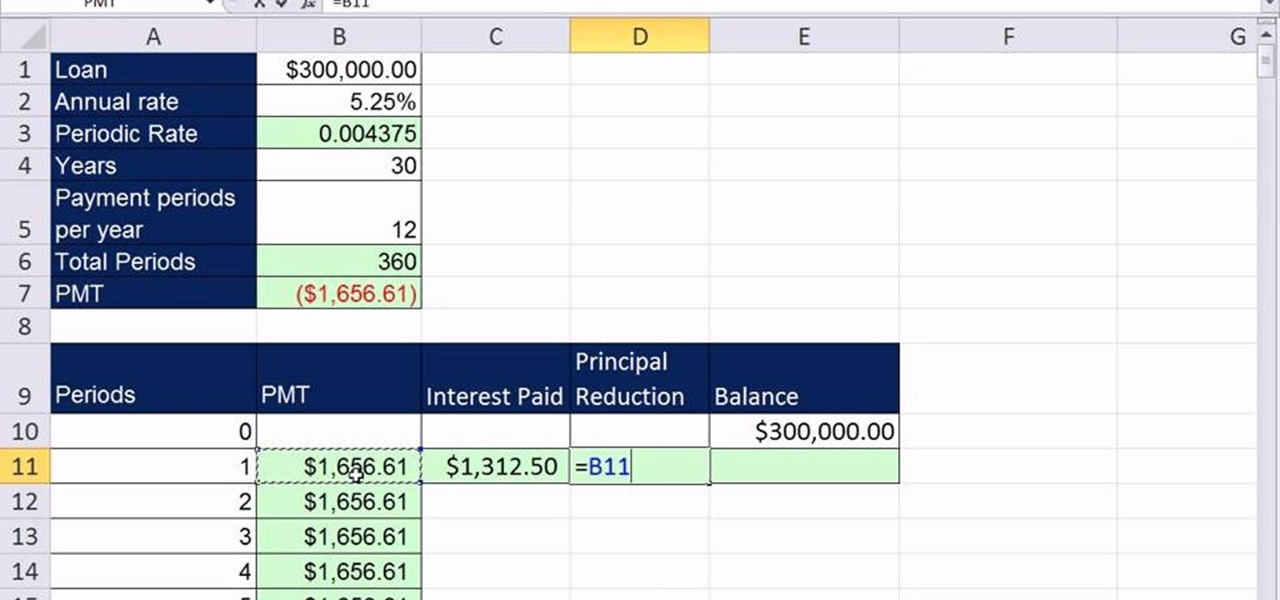

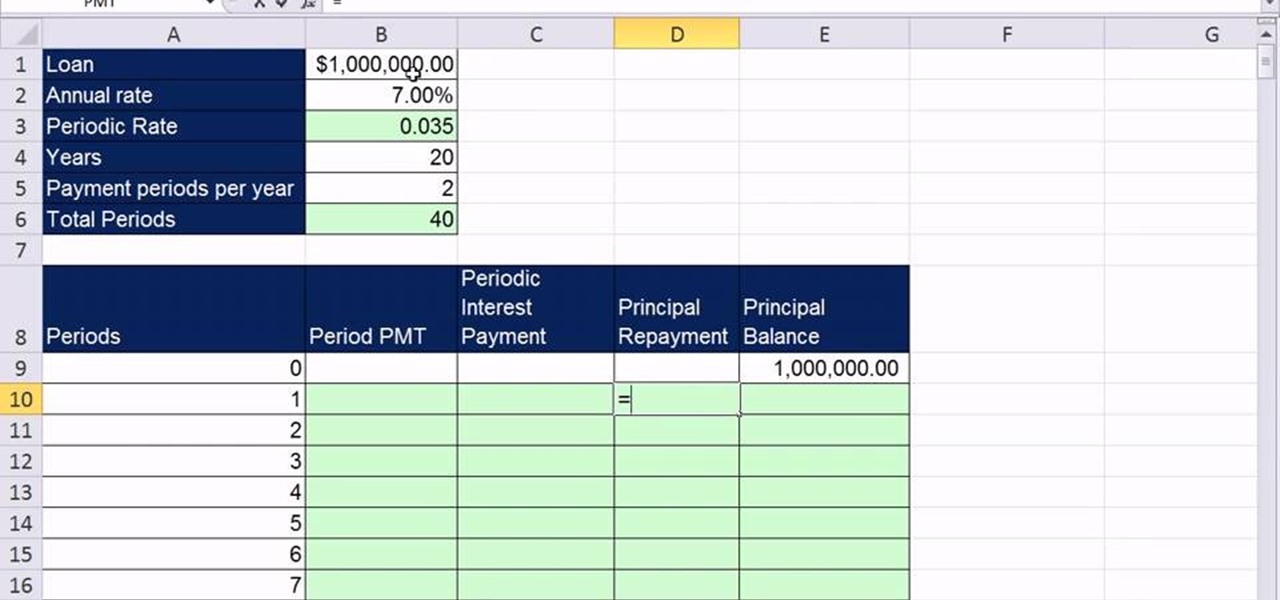

In this three-part video tutorial, learn how to manage loans with an amortization table in Excel. The three parts of this video go over the following:

Is the augmented reality magic fading down in Plantation, Florida? That's the first question some may be asking following a casual revelation over the weekend that Magic Leap, the maker of the Magic Leap One, has assigned much of its patent portfolio over to JP Morgan Chase as collateral.

Are you under a backbreaking amount of debt? In this economy, we don't blame you. If credit card bills, mortgages, and bank loans are making you want to crawl into bed and pull the covers over your face, then check out this video to learn how to consolidate debt.

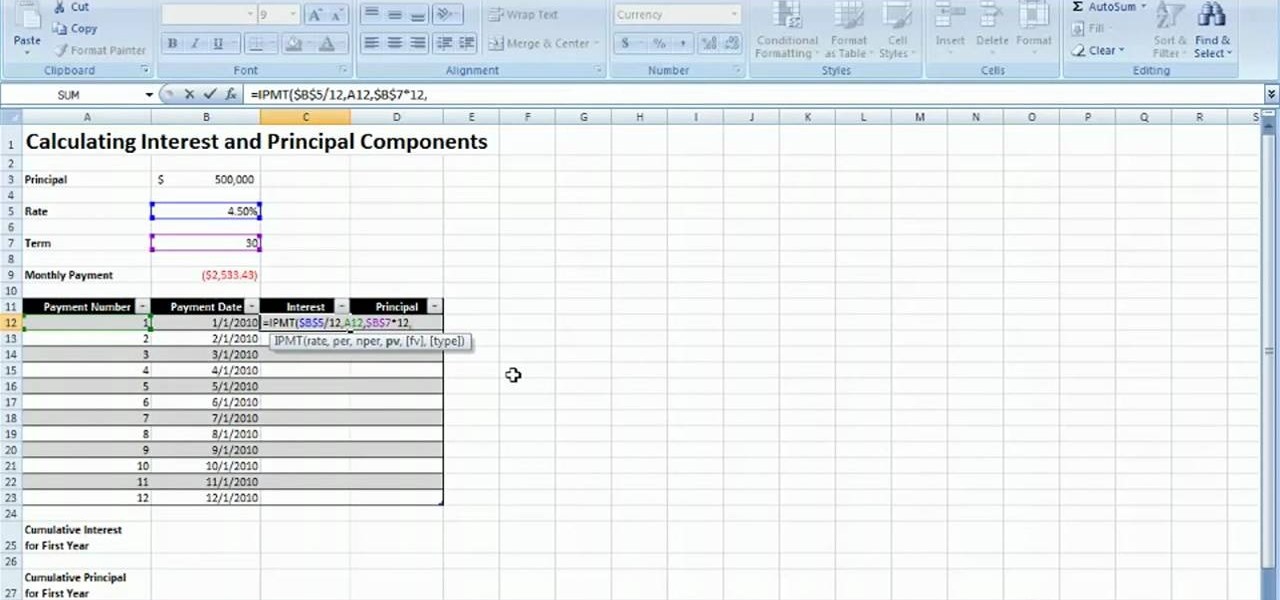

Learn how to calculate interest on loan payments with Microsoft Excel 2007. Whether you're new to Microsoft's popular digital spreadsheet application or a seasoned business professional just looking to better acquaint yourself with the Excel 2007 workflow, you're sure to be well served by this video tutorial. For more information, and to get started making your own loan payment calculations, watch this free video guide.

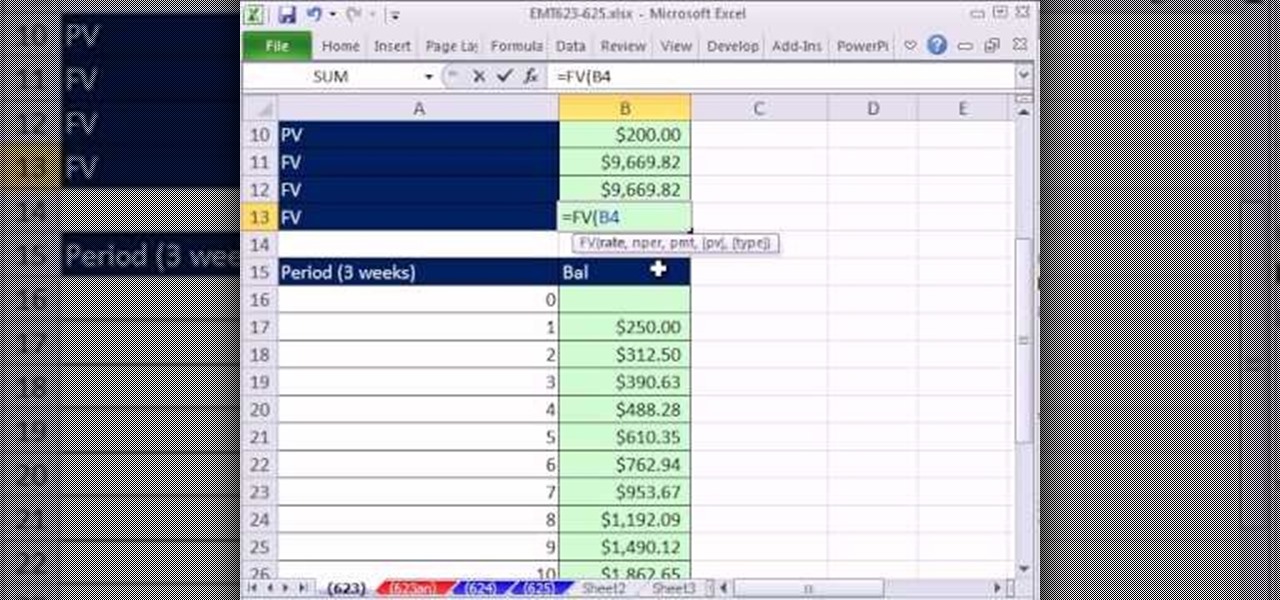

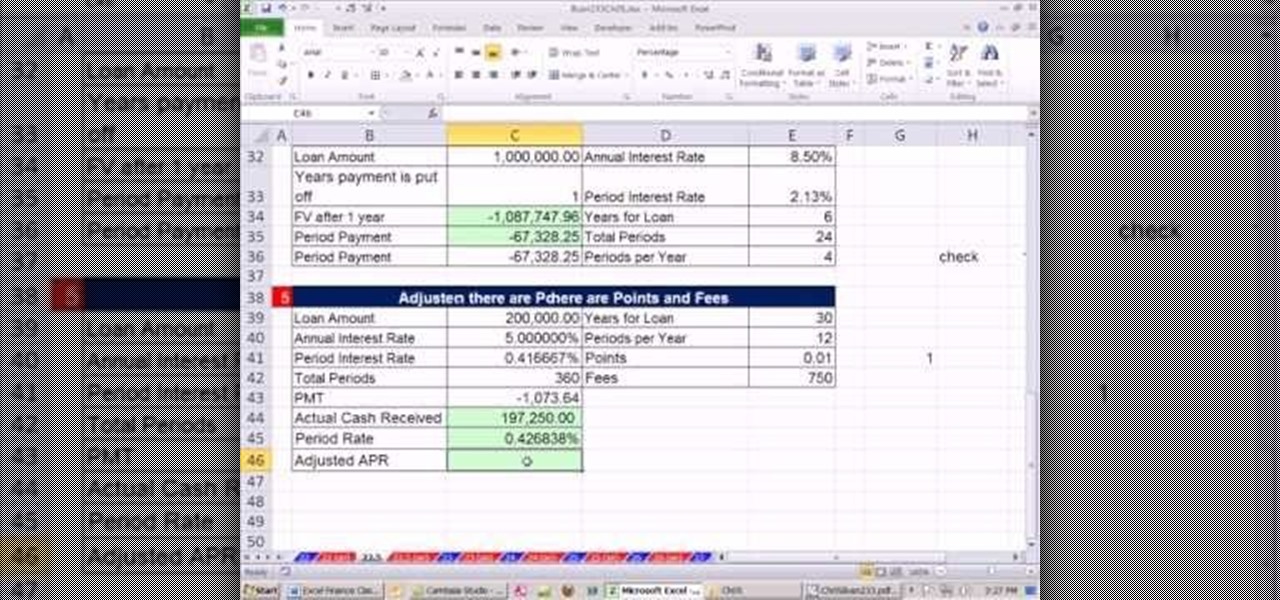

New to Microsoft Excel? Looking for a tip? How about a tip so mind-blowingly useful as to qualify as a magic trick? You're in luck. In this MS Excel tutorial from ExcelIsFun, the 623rd installment in their series of digital spreadsheet magic tricks, you'll learn how to see the pain that pay day loans inflict on people using Excel. Learn how to calculate APR (Annual Percentage Rate), EAR (Effective Annual Rate), an Amortization Table and the EAR for a loan that takes a fee out up front. Learn ...

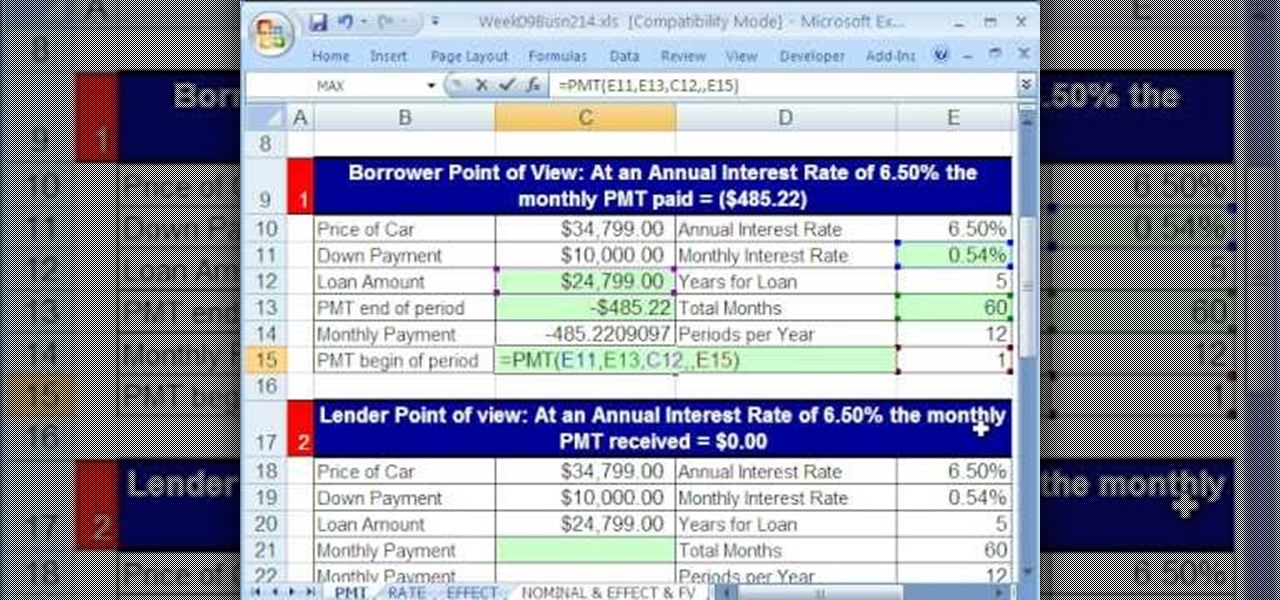

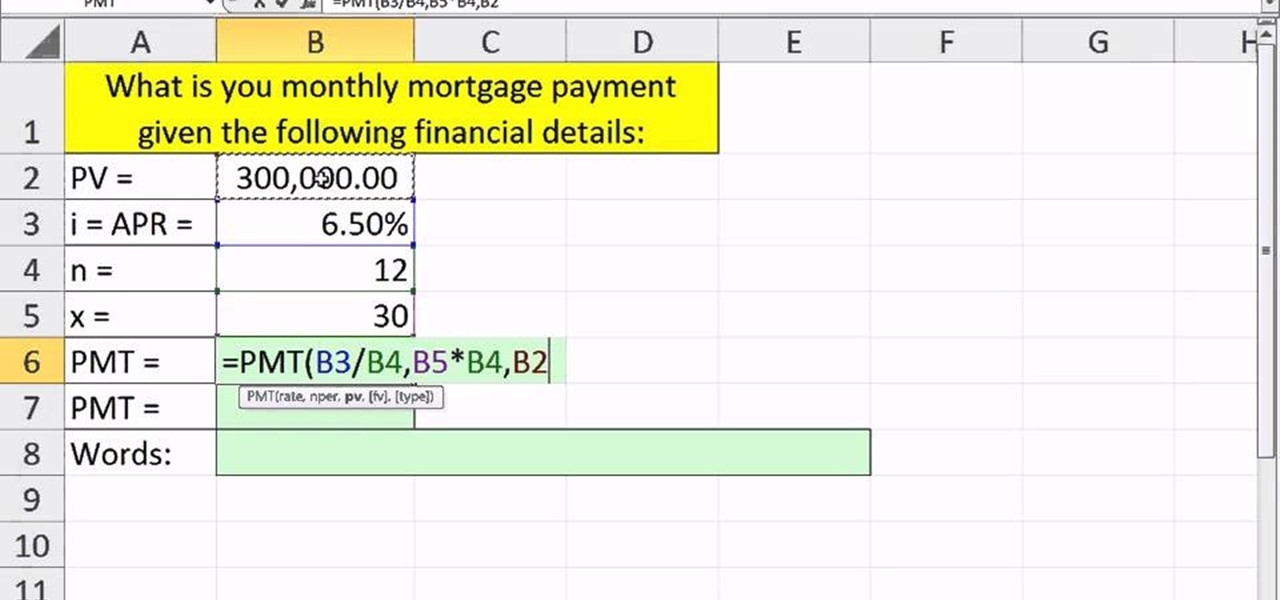

Whether you're interested in learning Microsoft Excel from the bottom up or just looking to pick up a few tips and tricks, you've come to the right place. In this tutorial from everyone's favorite digital spreadsheet guru, ExcelIsFun, the 47th installment in his "Highline Excel Class" series of free video Excel lessons, you'll learn how to use the PMT function to calculate payments. Specifically, this video addresses the following topics:

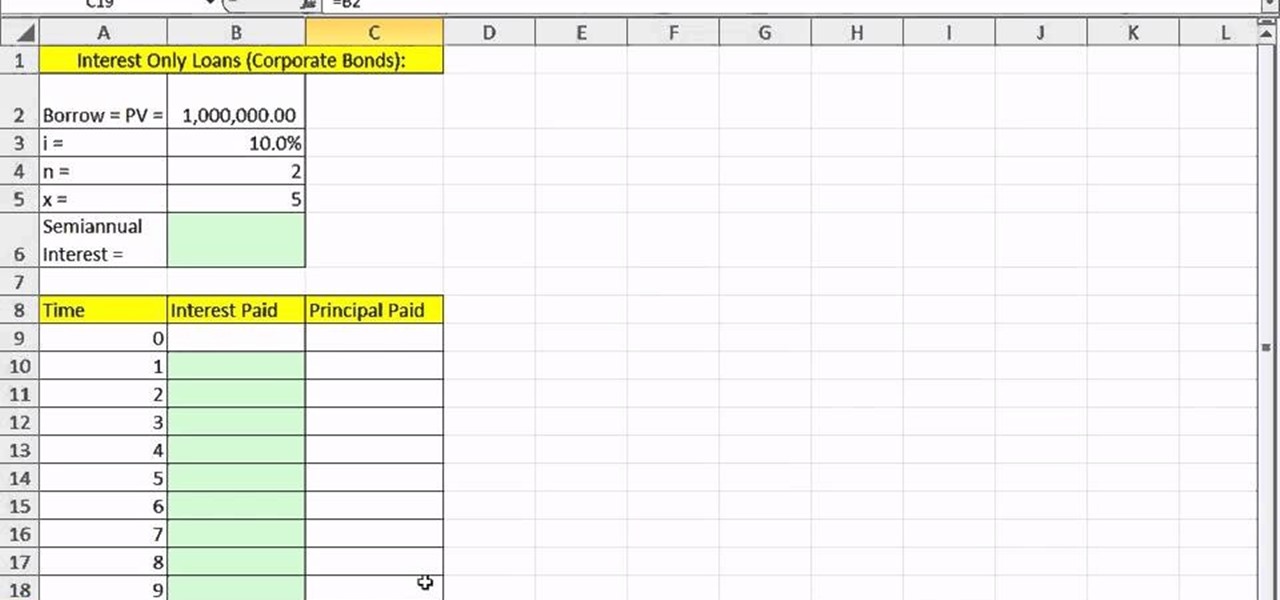

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 12th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to create an interest-only loan schedule in Excel.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 4nd installment in his "Excel Finance Class" series of free video lessons, you'll learn how to build an amortization table for a consumer loan in Excel with the PMT function.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 43rd installment in his "Excel Finance Class" series of free video lessons, you'll learn how to create an amortization table for a business loan with Excel's PMT function.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 44th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to build an amortization table for a deep discount loan in Excel.

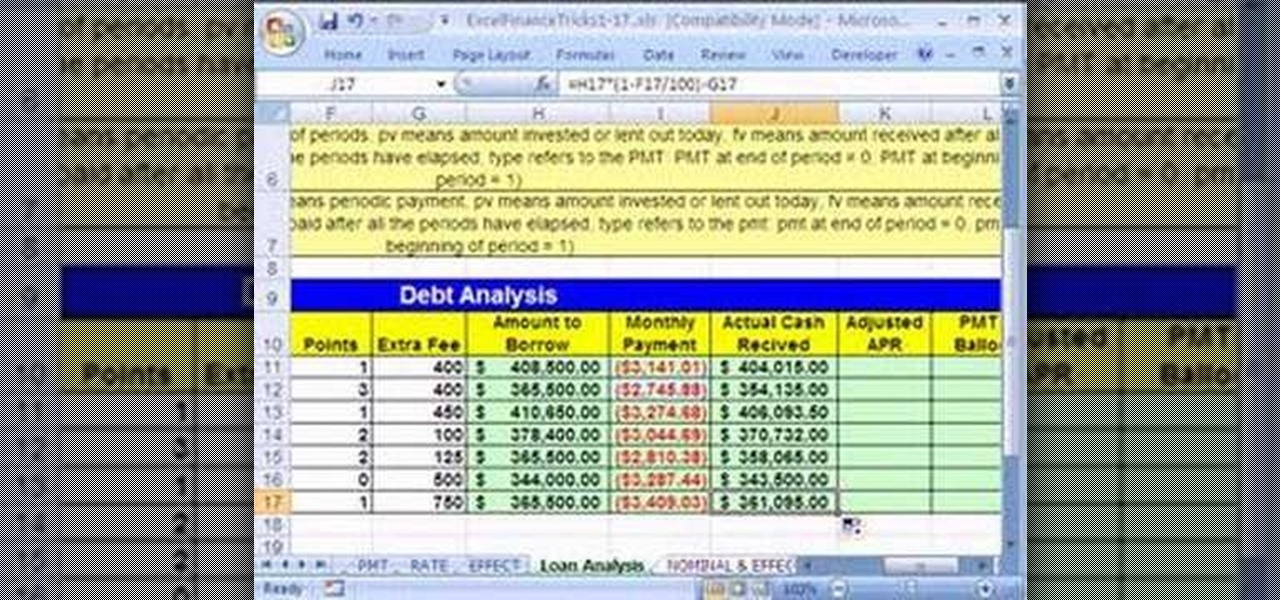

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 18th installment in his "Excel Finance Trick" series of free video lessons, you'll learn how to use the PMT and RATE functions for a complete debt/loan analysis.

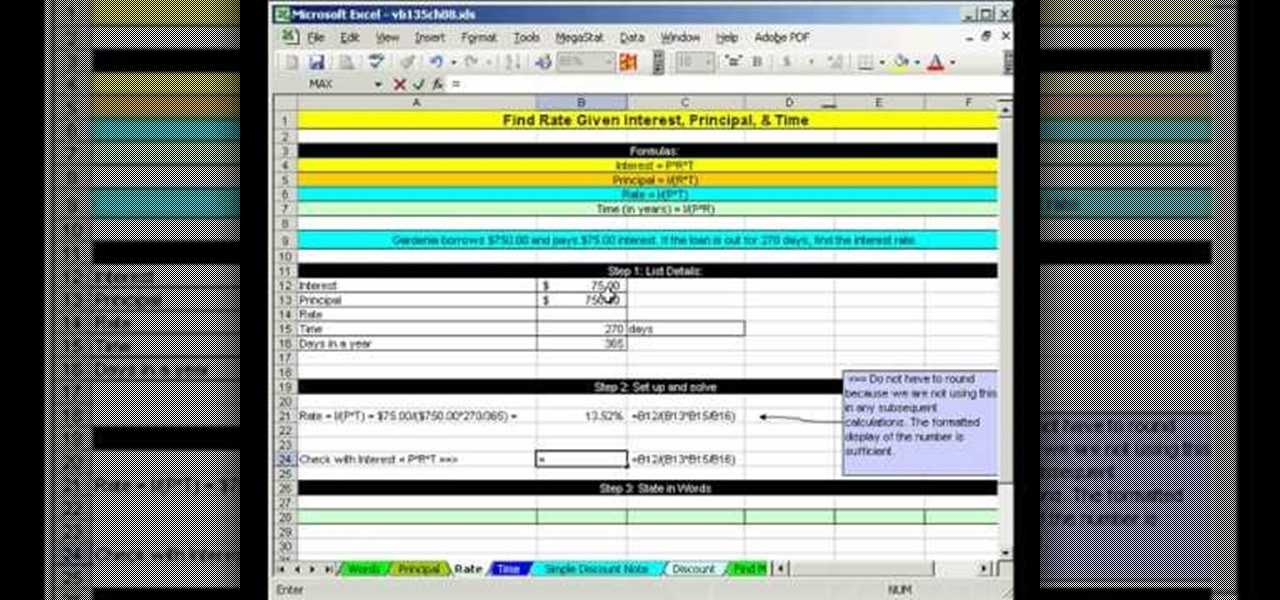

As you might guess, one of the domains in which Microsoft Excel really excels is business math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 54th installment in his "Business Math" series of free video lessons, you'll learn how to solve a simple interest loan problem for part, base, or rate.

Looking to get an FHA loan? The Federal Housing Administration, FHA for short, provides mortgage insurance on loans made by FHA-approved lenders throughout the U.S. Here's how to get your FHA-insured loan. Learn how to get one with help from this video.

The video demonstrates the way of calculating the interest rates for payday loans using MS Excel. The person presenting the video has got his MS Excel sheet with all the formulas and data ready. He first starts with the nominal & effect & future value tab. He gives us an example where you give the lenders a check of $250 that has a date 25 days in future and get $200 loan today. Now he teaches us hot to calculate APR and EAR. HE has got the data ready there, the period of the loan which is 25...

As expected, Magic Leap closed a Series D round of equity funding, raising $502 million from new and existing investors. Less expected, however, were a fresh set of rumors that the company's first devices could ship within six months.

Augmented and virtual reality motion tracking leader Leap Motion, Inc. announced that it has secured $50 million in Series C funding to fund expansion into new territories and industries.

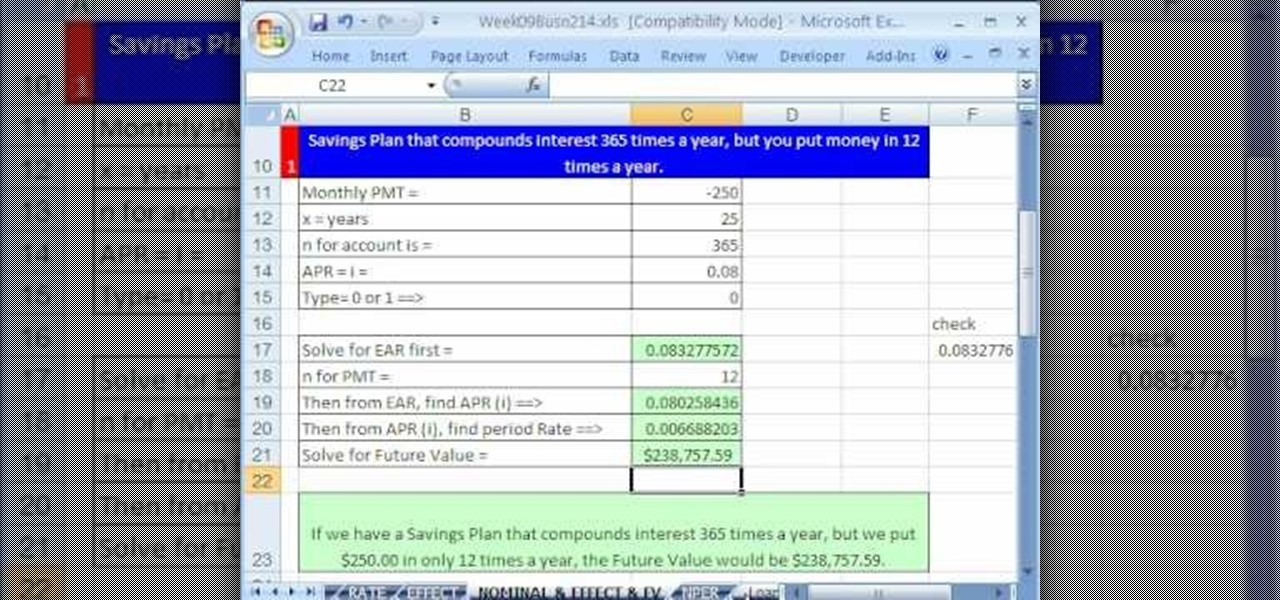

Whether you're interested in learning Microsoft Excel from the bottom up or just looking to pick up a few tips and tricks, you've come to the right place. In this tutorial from everyone's favorite digital spreadsheet guru, ExcelIsFun, the 48th installment in his "Highline Excel Class" series of free video Excel lessons, you'll learn how to use the RATE, EFFECT, NOMINAL and NPER Excel functions to solve the following problems:

When someone you love asks for money it can be very hard to turn them down; especially since you are usually put on the spot. Check out this tutorial and discover ways that you can help your friend without having to spend a dime, and make things easier for everyone.

Need money fast but don't want to take out a loan? Asking a friend or family member for money is a sensitive undertaking. If you take the necessary steps, you’ll get what you need and ensure them that their money will be repaid.

Many action or crime dramas revolve around briefcases full of money. But you're just an indie film maker - you don't have that much money! How can you make a convincing briefcase full of money without having to take out a small loan? Indy Mogul is here to show you how!

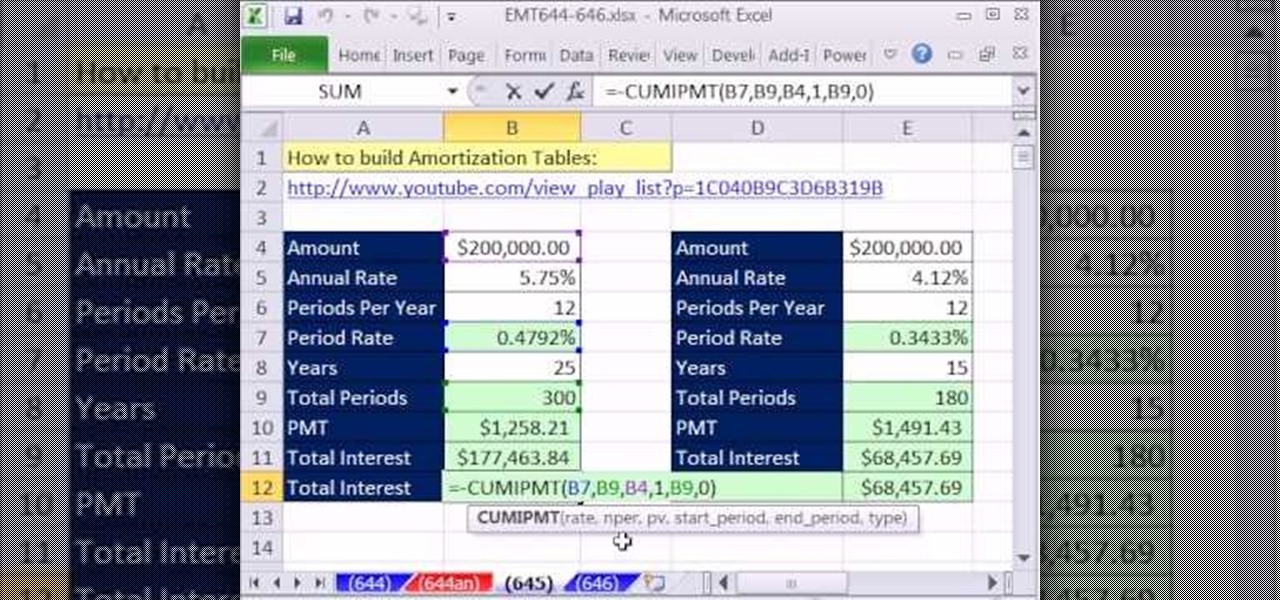

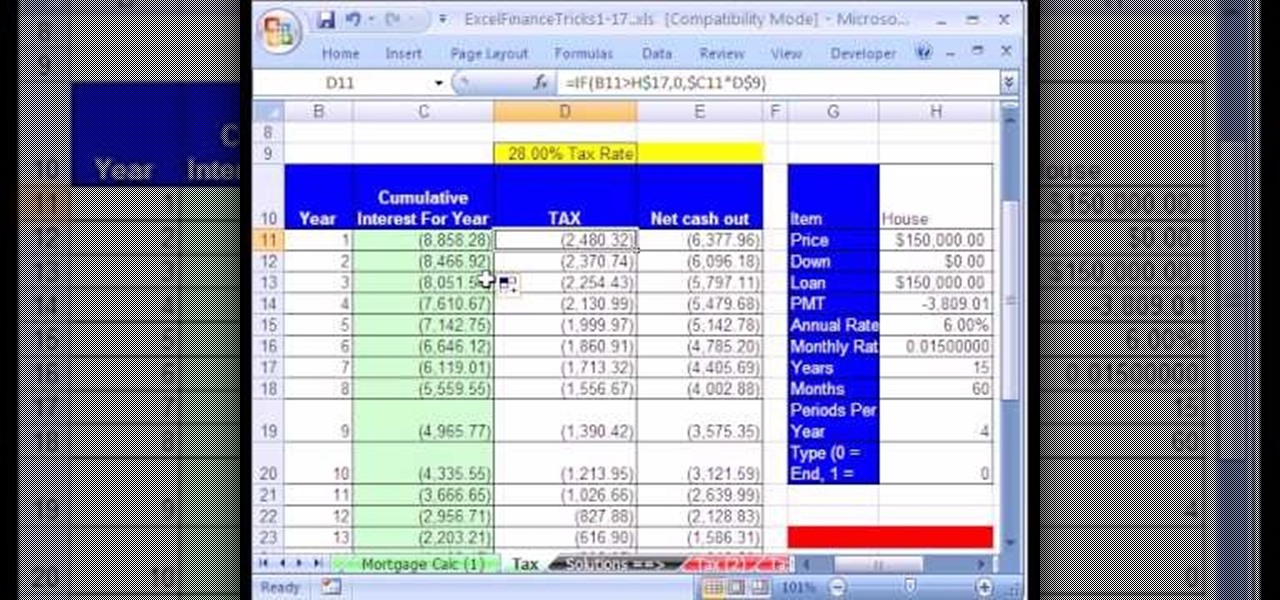

New to Microsoft Excel? Looking for a tip? How about a tip so mind-blowingly useful as to qualify as a magic trick? You're in luck. In this MS Excel tutorial from ExcelIsFun, the 645th installment in their series of digital spreadsheet magic tricks, you'll learn how to use the CUMIPMT function to calculate the total interest paid for two different loans.

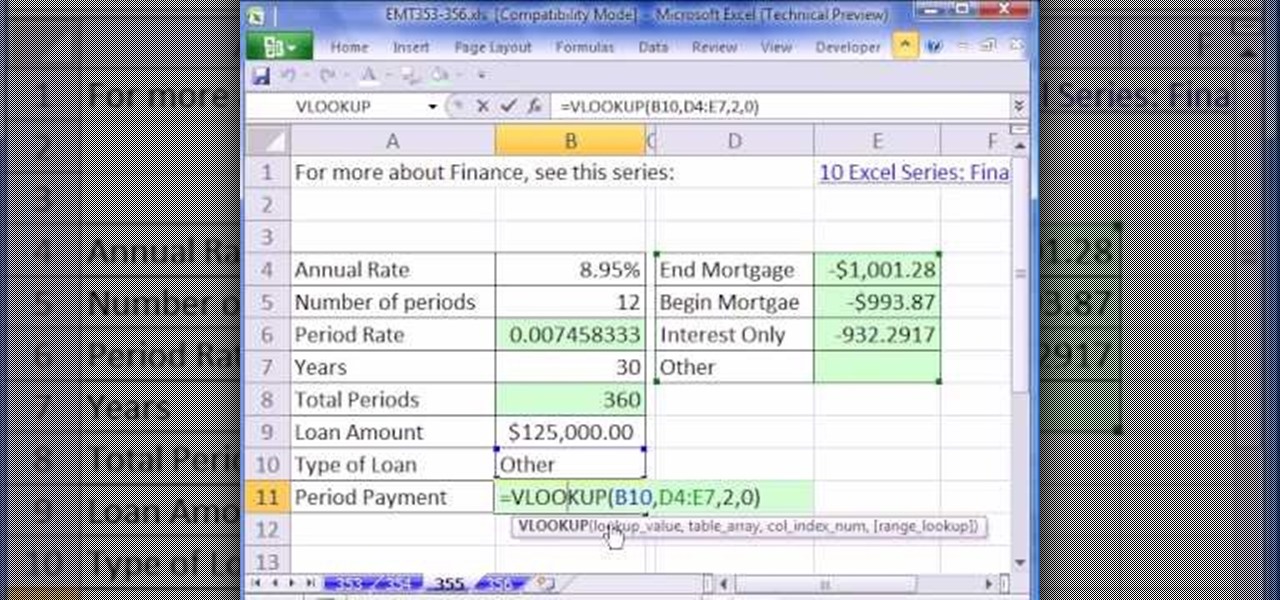

New to Microsoft Excel? Looking for a tip? How about a tip so mind-blowingly useful as to qualify as a magic trick? You're in luck. In this MS Excel tutorial from ExcelIsFun, the 355th installment in their series of digital spreadsheet magic tricks, you'll learn how to use VLOOKUP to create a mortgage calculator that can handle four different types of loans: begin annuity, end annuity, interest only and "other."

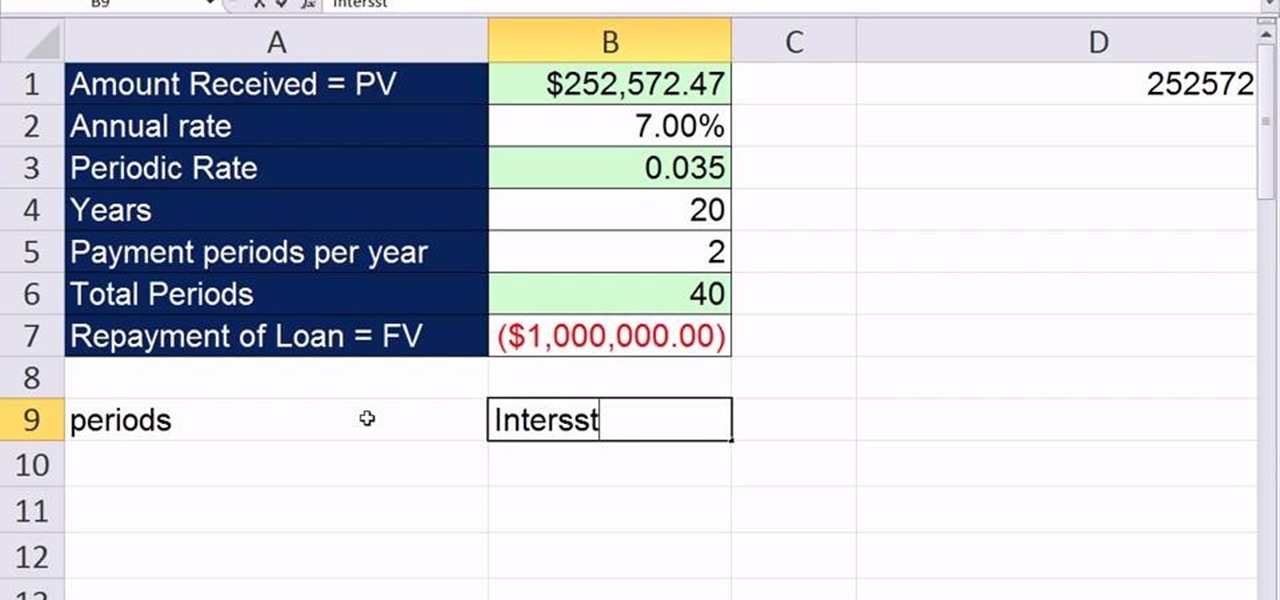

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 35th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate the present of a loan with the PMT function.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 12th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate average and marginal tax rates with Excel.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 18th installment in his "Excel Finance Trick" series of free video lessons, you'll learn how to use the CUMIPMT function to calculate the cumulative interest on a loan for a 1 year period.

A makeover can make laundry day more enjoyable and boost a home's equity. This how to video is a quick excerpt from a DIY show. Watch as it demonstrates how to redo a laundry room by removing mold, painting the walls and floors, and installing a few gadgets that will help out with clothes washing.

Now more than ever, people everywhere are suffering from bad credit. Credit is important. You need it to take out loans, buy a house, rent an apartment, get a car, almost anything! Check out this two part video, presented by Daniel Medina from United Credit Education Services, and listen along as he offers you tips on how to improve your credit - even in a recession. This helpful and informative video can start you on the right track to financial stability, no matter what the circumstances.

This parlor trick video aptly demonstrates how to open a bottle of wine with an ordinary swiss army knife when that feisty cork screw goes missing. This video is a great alternative for college students who seem to inevitably misplace or loan their cork screws and want to seamlessly open and enjoy a nice glass of wine.

With the third season of Netflix's hit series Stranger Things set to debut July 4, it's time to crank up the hype machine, this time, in augmented reality.

In a legal brief entered on Monday, Florida-based startup Magic Leap has filed suit against the founder of Nreal, a former employee of Magic Leap, claiming that the company's Nreal Light smartglasses were built using Magic Leap's intellectual property.

In the wake of Apple and Google pitching augmented reality to schools, McGraw-Hill is stepping up its own augmented reality efforts for education.

In the current state of the augmented reality space, Leap Motion is the only well known name in DIY AR headset kits with its Project North Star design, which gives makers the blueprints to build their own headsets.

While these days it is better known for the cross-platform gaming sensation Fortnite, Epic Games also makes Unreal Engine, one of the top development environments for 3D content and, in turn, augmented reality and virtual reality experiences.

Another massive piece of the mysterious augmented reality puzzle known as Magic Leap fell into place on Wednesday as AT&T announced that it will be the exclusive launch carrier for the device.

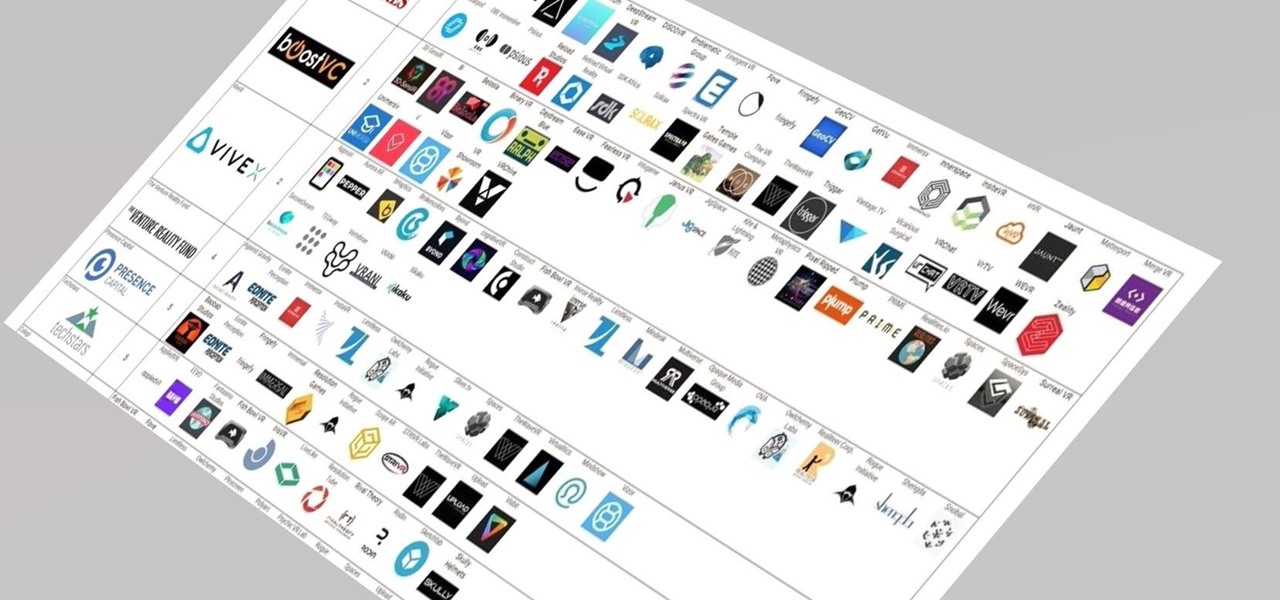

While many analysts predict that the market for augmented and virtual reality will continue to grow over the next five years, now is the time for investors to get in on the ground floor.

Katherine Miller teaches the secrets of starting your term paper research by using concept mapping method. Use a large sheet of paper and a marker to map out our ideas. First take an example like "Succeeding at college and grades" and write down the factors affecting your goal. The most common factor is money, now write down the things that has an impact on money like jobs, business and loans. The other factors are outside life, health, places for help and study habits. Simultaneously write i...