News: Tencent Deepens Its AR Investment Portfolio with $50 Million in Funding for Ultraleap

Over the past decade, China tech giant Tencent has invested in several companies with varying roles in the augmented reality industry.

Over the past decade, China tech giant Tencent has invested in several companies with varying roles in the augmented reality industry.

Just a week after rumors surfaced of a massive new investment in Magic Leap led by Saudi Arabia's Public Investment Fund (PIF), the investment has been confirmed by the company's CEO Rony Abovitz.

It's safe to say that we can call the annual ranking of AR investments a holiday tradition at Next Reality.

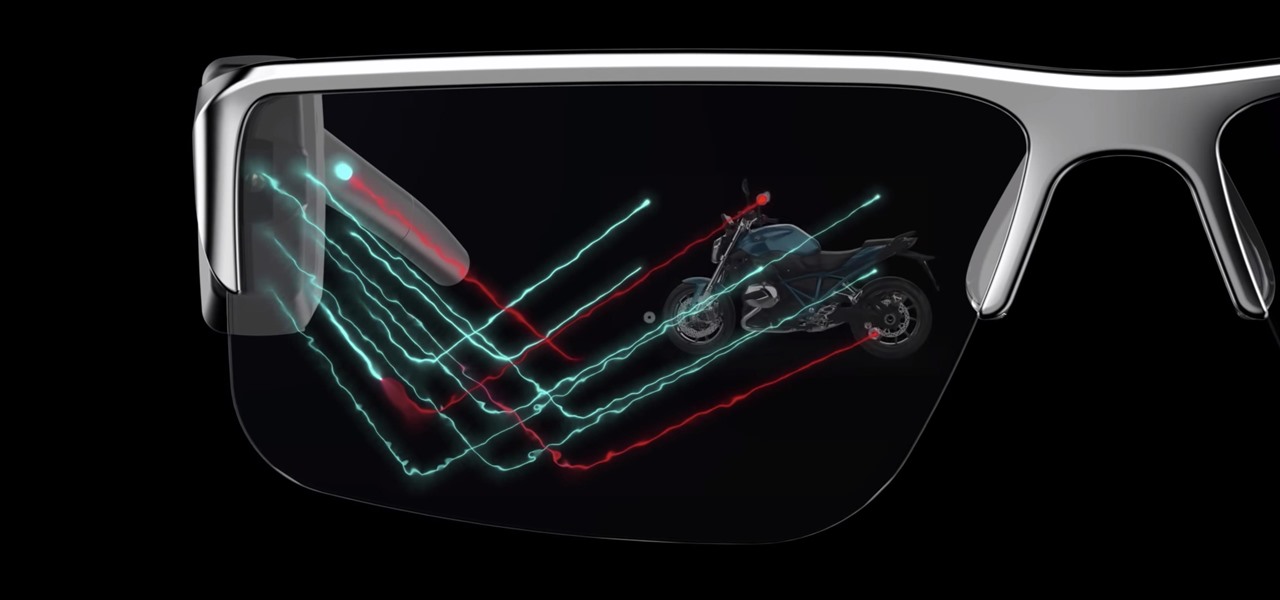

Smartglasses are the future of augmented reality, and Samsung is betting on waveguide maker DigiLens to emerge as a leader in the growing AR wearable industry.

Google's AI investment arm, Gradient Ventures, has joined a $10.5 million round of funding for Ubiquity6 and its platform for shared augmented reality experiences, just weeks after Google's GV fund backed a competing AR cloud platform.

As the calendar year (and, for many companies, the fiscal year) comes to a close, it appears 2017 may stand as the new high-water mark for investment in augmented and virtual reality technology.

Last year's augmented reality investments roundup was impressive. And in 2018, the dollars flowing toward AR haven't decreased, as venture capitalists and strategic investors continue to aggressively fund AR startups at a rapid pace.

As the Notorious B.I.G. once said, via his hit single, "Mo Money, Mo Problems." However, it would appear that Magic Leap feels a bit differently about piling on the cash.

While Magic Leap turned heads at the Game Developers Conference with AR experiences at the Unity and Unreal Engine booths, news broke that the company was the winning bidder for ODG's patents.

Enterprise augmented reality software provider Upskill has raised $17.2 million in its latest round of funding, led by new investors Cisco and Accenture.

Waveguide manufacturer DigiLens has closed a $25 million Series C round of funding from automotive technology company Continental, which uses the technology in its heads up displays.

Four months have passed since Mojo Vision emerged from stealth, and we are no closer to seeing exactly what its "invisible computing" technology looks like.

With Pokémon GO as its cash cow and the forthcoming Harry Potter: Wizards Unite and Niantic Real World Platform promising future revenue streams, Niantic has convinced investors to bet on its flavor of augmented reality

The recent announcement of a $480 million US Army contract awarded to Microsoft over Magic Leap for supplying 100,000 augmented reality headsets shows just a how lucrative the enterprise (and government) sector can be for AR.

This week, two companies preparing the most anticipated augmented reality devices for consumers were the subject of reports regarding strategic moves to put them in better positions to move those products forward.

Investing is like exercise—we all know we should be doing more of it, but we often just can't find the time. I mean, really, who's got the hours, inclination, and skill to pour through volumes of data and put together a balanced yet sophisticated portfolio of investment vehicles tailored specifically to optimize their returns while mitigating potential risks. Not me, that's for sure.

The foreign exchange, or forex, market is a relatively safe place to invest money, but like with any investment research and understanding indicators are key to making profits. Watch this video to learn how to use forex trading spreads to read the market and make sound investments.

It may sound like deja vu, but neural interface startup CTRL-labs has closed a $28 million funding round led by GV, Google's funding arm, for technology that reads user's nerve signals to interpret hand gestures.

Smartglasses and AR headset makers like Microsoft, Magic Leap, and Google (and aspiring AR wearables makers like Apple and Snapchat) need display components for their products, and LetinAR is among the companies ready to supply those components.

Investors are ready to throw their money at augmented and virtual use cases that demonstrate a business purpose and a return on investment.

As augmented reality gains popularity, the demand for delivering related services and generating content increases. This is demonstrated by a pair of investments from the past week, one in the expansion of a technology lab and another in the form of seed funding for a content studio.

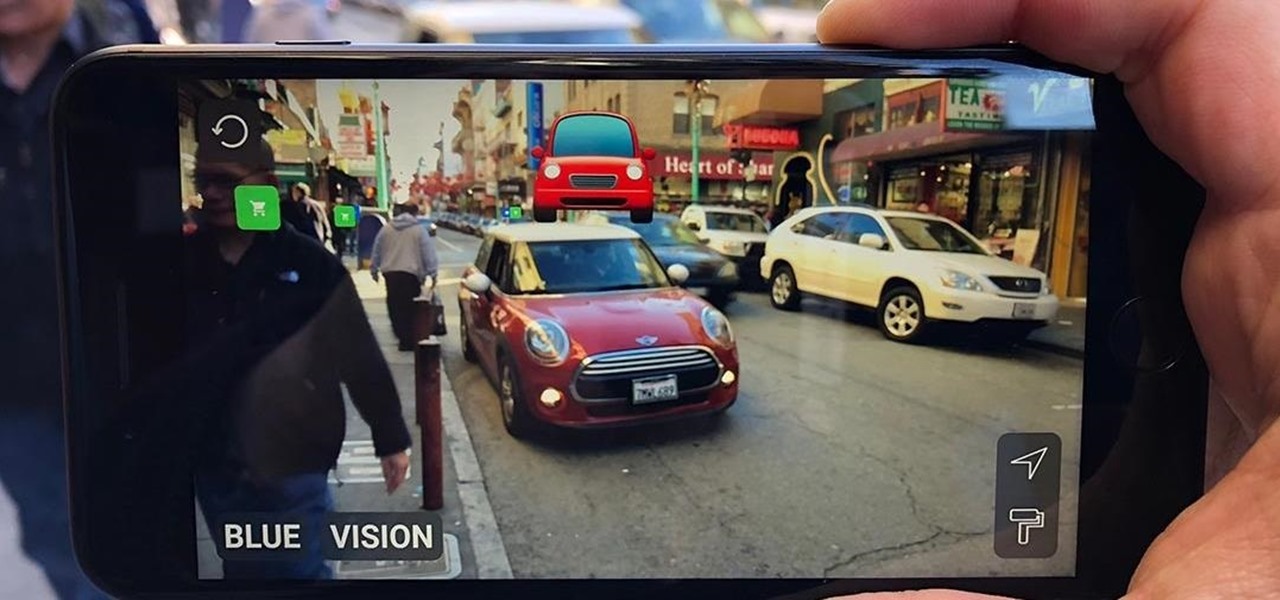

With would-be unicorns Magic Leap and Niantic among its investments, Google is an active investor in augmented reality technology. This week, the search giant experienced both ends of the investment cycle, with an exit via Lyft's acquisition of Blue Vision Labs, and a funding round for Resolution Games.

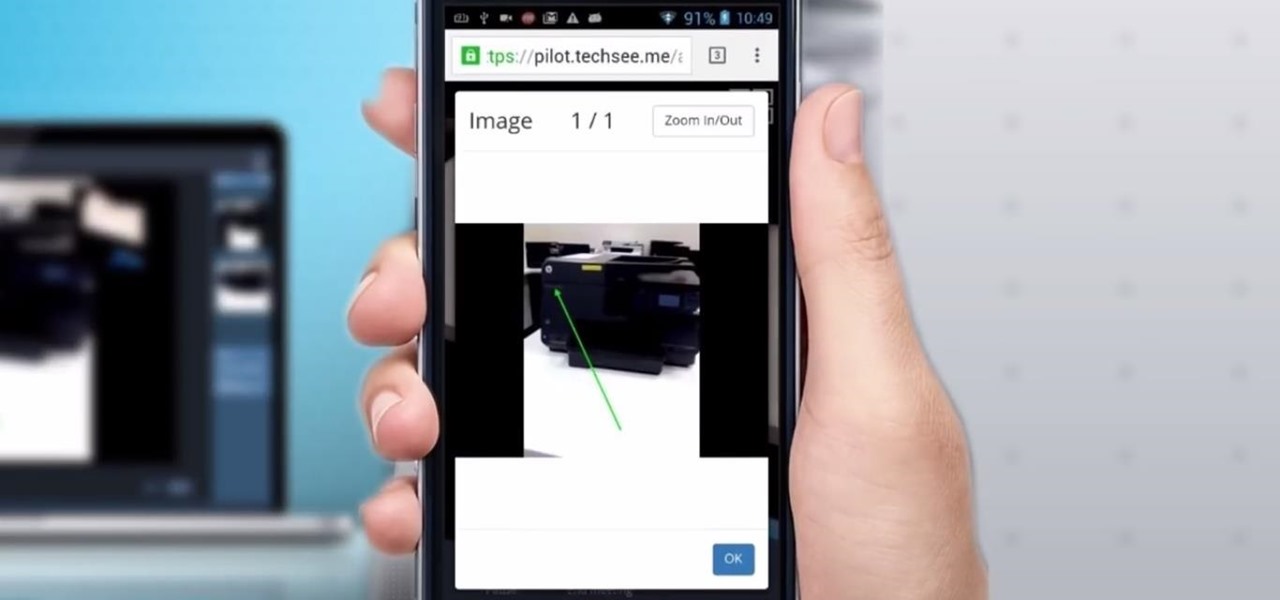

Four augmented reality companies made deals this week to grow their businesses. Two companies, TechSee and Car360, completed funding rounds, while DAQRI signed with a production partner and Decalomania landed a prime spot with a top retailer.

The augmented reality industry has an insatiable lust for 3D content, which makes an investment of $48 million into Matterport a no-brainer for investors.

Although Niantic is already an augmented reality startup unicorn thanks to the success of Pokémon GO, the company has reportedly captured yet another round of funding.

The company behind augmented reality's first real gaming hit, Pokémon GO, is quietly making moves toward supporting the rapidly growing smartglasses space that may one day move its content away from smartphones and tablets and onto AR lenses positioned on your face.

Fresh off shipping an augmented reality game for Magic Leap, Resolution Games has farmed another $7.5 million in funding through a Series B round.

The display is one of the most critical components in augmented reality hardware, and on Tuesday, one of the companies making that component, Avegant Corp., closed a funding round of $12 million to support development of next-generation AR displays.

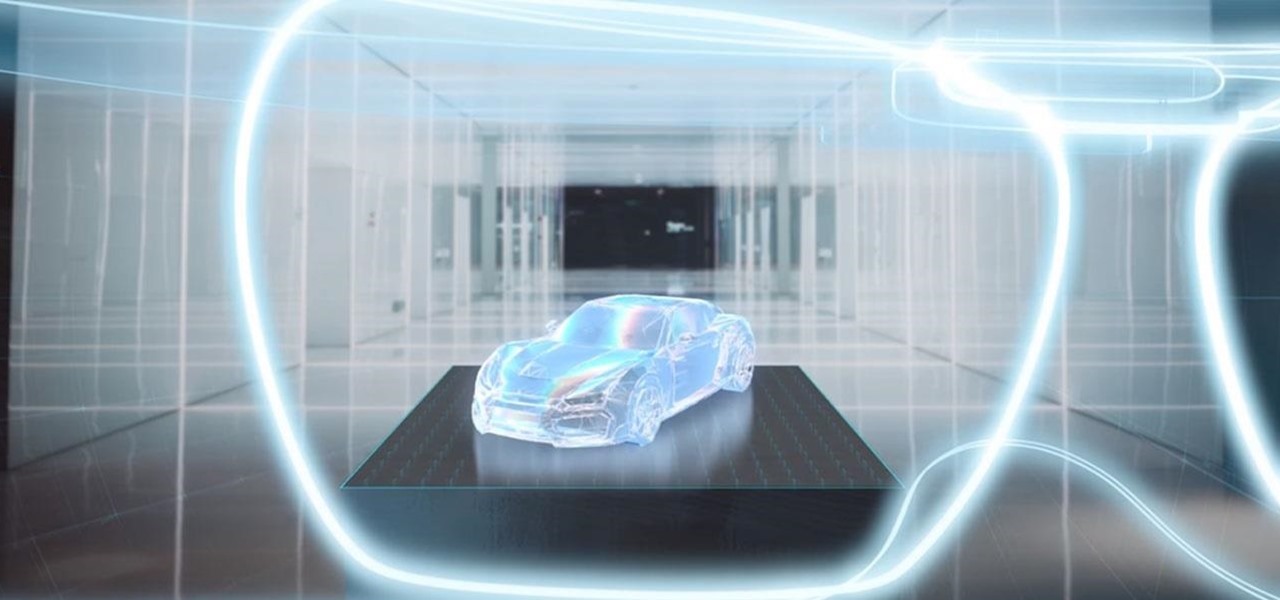

With the British exit from the European Union looming, the UK is looking to the auto industry to help boost their economy and secure jobs through the upcoming years. Today, Business Secretary Greg Clark and Transport Minister John Hayes announced the government investment of $136.7 million (£109.7 million) across 38 different automobile projects, as a part of the Plan for Britain.

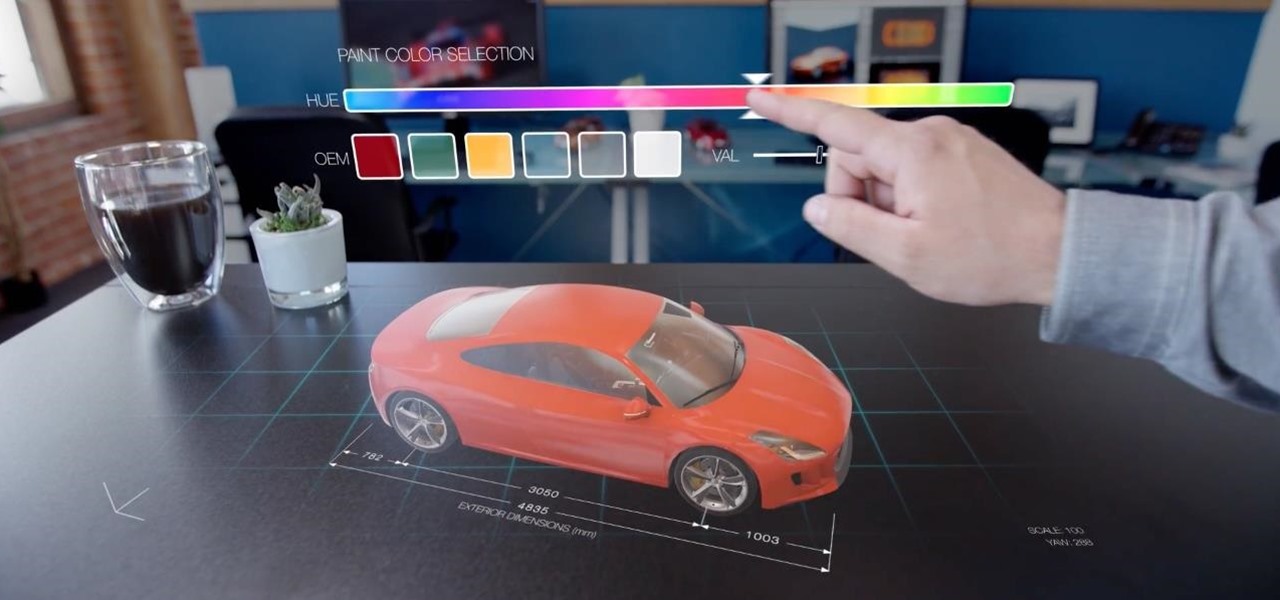

Some investors play the short game, placing their bets on industries that show the quickest return on their investment, and, in the augmented reality space, that means the enterprise sector.

Nauto, which develops driver-monitor cameras and algorithms for autonomous vehicles, is among a growing list of driverless startups able to attract tens of millions of dollars in funding after raising $159 million in its latest round of financing.

While many analysts predict that the market for augmented and virtual reality will continue to grow over the next five years, now is the time for investors to get in on the ground floor.

Augmented reality can be used to fascinate and entertain, but it can be applied in the workplace. While companies on the entertainment end received their votes of confidence via funding, two companies working with enterprises demonstrated their worth by teaming up to pursue customers.

It turns out that the government of Saudi Arabia has managed to do something last month's Game Developers Conference couldn't — give us a few new glimpses of the Magic Leap One being worn by someone other than Shaq.

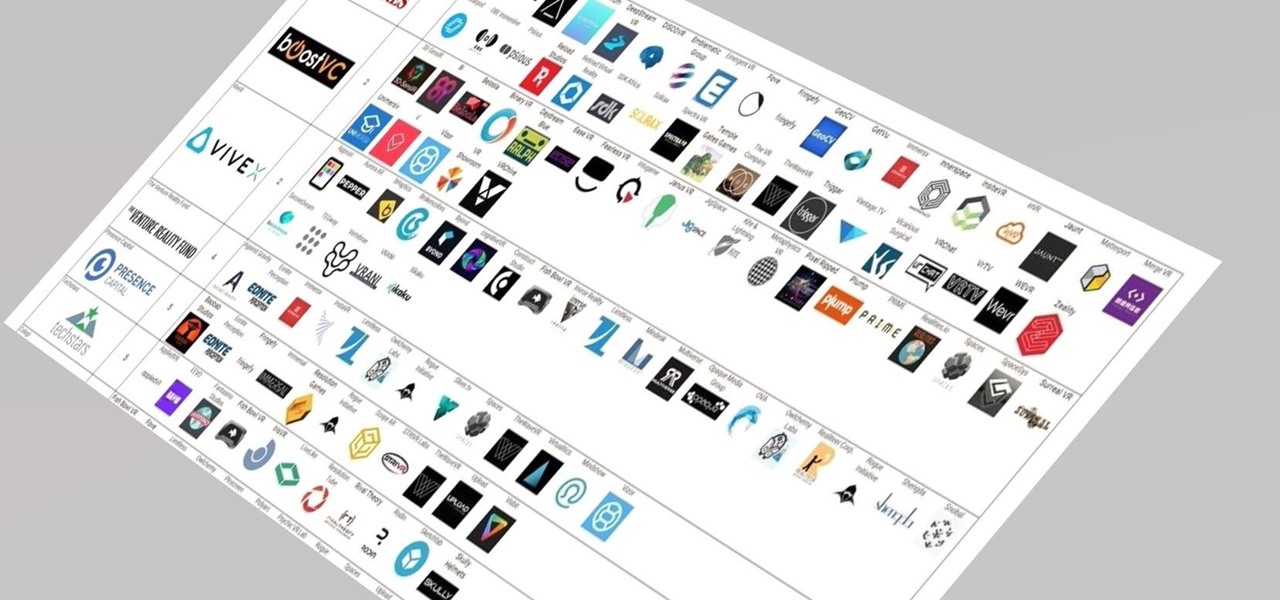

According The Venture Reality Fund, the introductions of Facebook's camera platform and Apple's ARKit catalyzed increased activity among companies developing consumer applications.

We continue to field stories underscoring the strong trends of Investment in augmented reality in various sectors. This week, one company strengthens their offerings to the enterprise sector, while two other companies capitalize on the promise presented by augmented reality to consumers – specifically, in gaming.

This week in Market Reality, we see two companies capitalizing on technologies that contribute to augmented reality platforms. In addition, industry mainstays Vuzix and DAQRI have business news of their own to report.

The 'net present value' is the difference between the initial cost outlay of making a product or an investment, and the present value of expected cash flow. Using the equation given in this video, you can start with the initial estimation and determine the net present value for your endeavor.

The business of enabling the development of augmented reality experiences appears to be as lucrative as AR app development itself.

The world of investment and finance can be labyrinthine in its very nature — and even more complicated in regards to augmented and mixed reality. While these new emergent technologies are teeming with explosive levels of unrealized potential, there's still a big layer of uncertainty in terms of return — but these investors aren't afraid to take the leap.