The Tax Calendar for Small Business and Self-Employed (Publication 1518) gives important information and needed dates for small business owners and self-employed people on the subject of business tax.

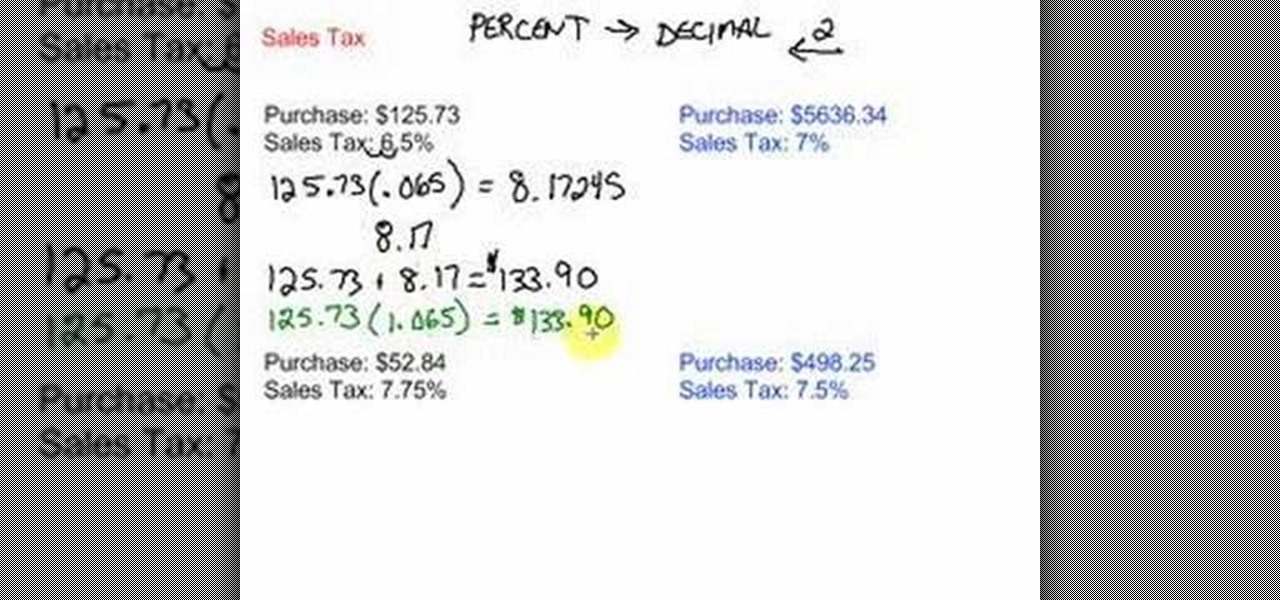

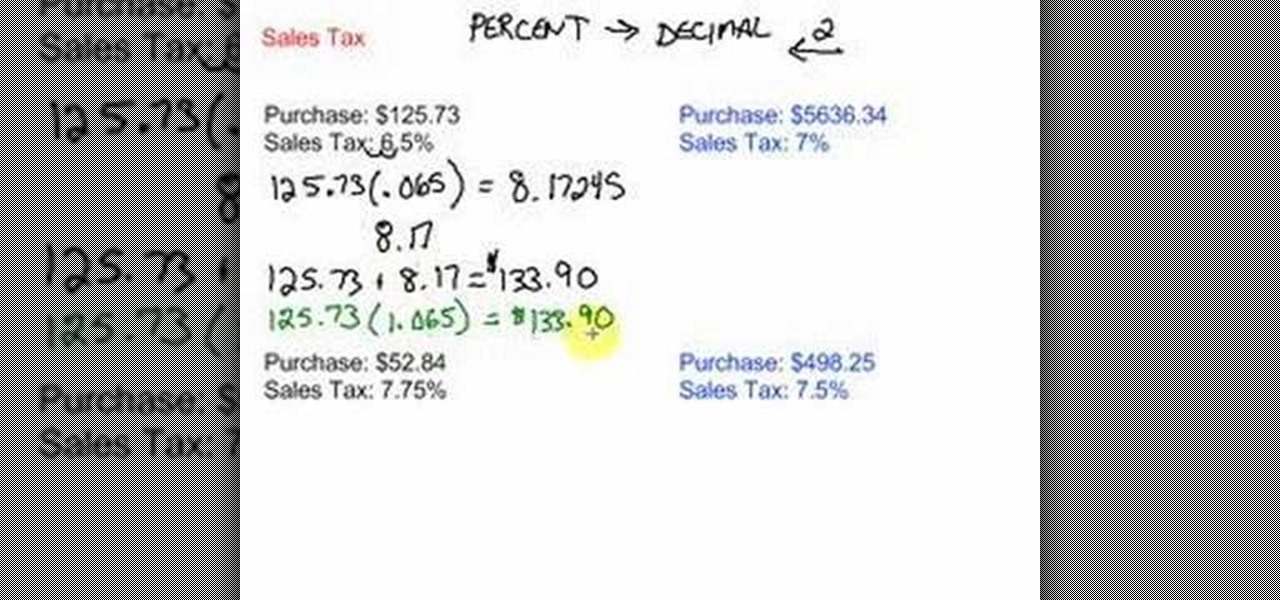

Video describing about how to calculate a sales tax price based on purchase price and sales tax percentage. There is one example which is described as below:

If you think you may have goofed on your tax return, you're going to want to file a 1040-X, which is an amended tax return. This quick video by the IRS shows how to do it, for this, or any of the previous 3 years.

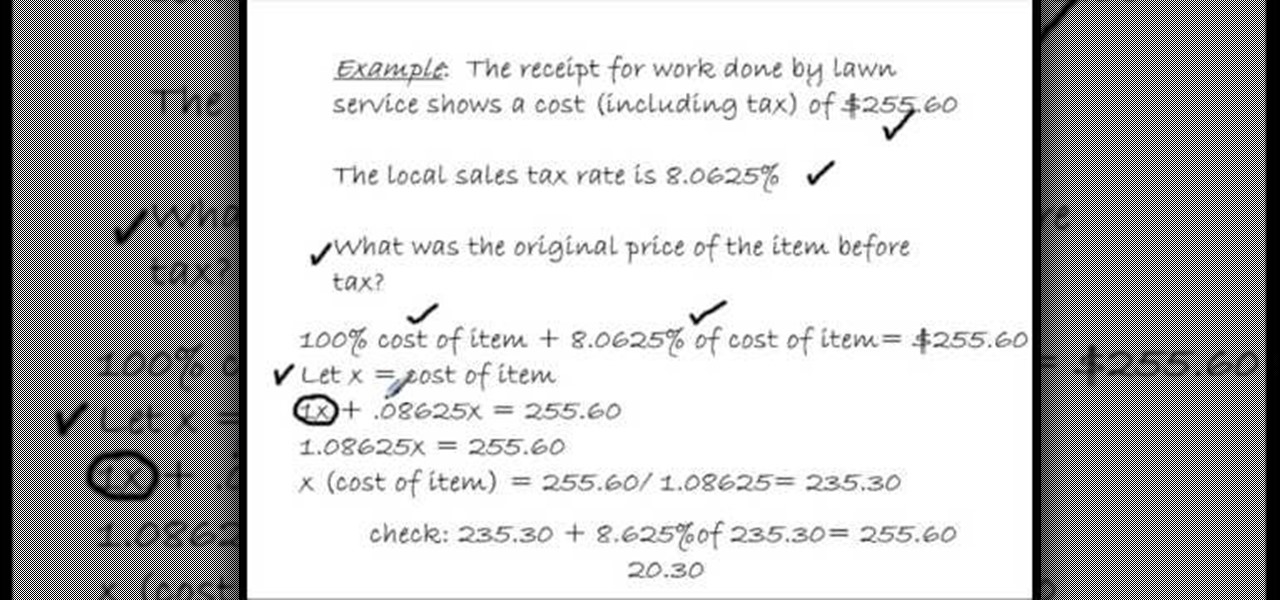

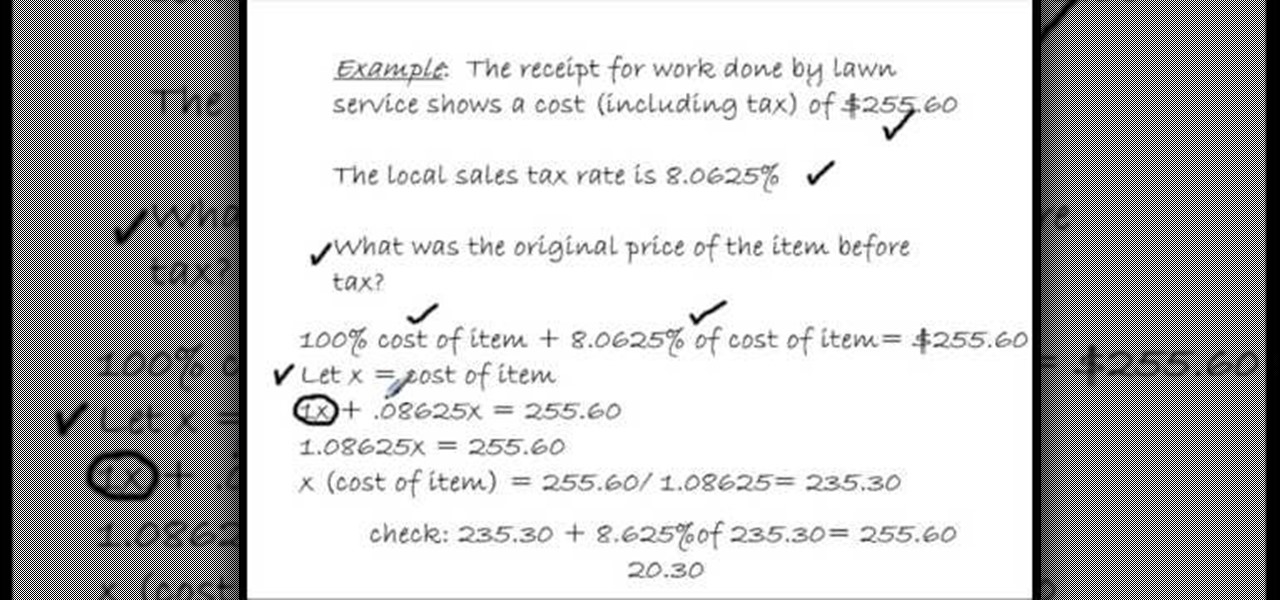

In this video, we learn how to back out the tax from a receipt. If you have a receipt where you see how much you paid and know the tax rate, except you want to figure out the cost of the item before the tax. First, take the cost of the item including tax and what the tax rate is. To figure out the original price, let x equal the cost of the item. Add the tax to the cost of the item which will equal the cost you paid. Perform the equation 1x+(tax rate)= (total price). After you figure this equ...

If you haven't filed a tax return in the past few years, you can go to the IRS to help you with filing past taxes and get you back on track. Find out in this video how you can get all caught up with your taxes.

It's mid-January and some of you happy tax-paying citizens have already started receiving your W-4s and 1099s in the mail. But before you start filling out your 2010 Federal Tax Return, make sure you're hip to all the tax tricks in 2011. You could end up saving some money!

Every year, many people fall victim to scammers trying to dupe taxpayers out of their hard-earned money. The IRS compiles an annual list of the twelve most popular tax scams perpetrated on the public. Check out this video to learn out about the top tax scams to avoid.

Want to see how your state tax refund is coming along? More often than not, it's very easy to check online. For details, including step-by-step instructions on how to check the status of your own state taxes, watch this handy view tutorial.

Getting ready to file your taxes? Good, but you're not sure how much you're going to be expecting in a refund? Need to calculate your deductions still? No worries. In this video you will learn how to use the IRS tax deduction calculator to figure out how many deductions you qualify for and what your refund will end up being.

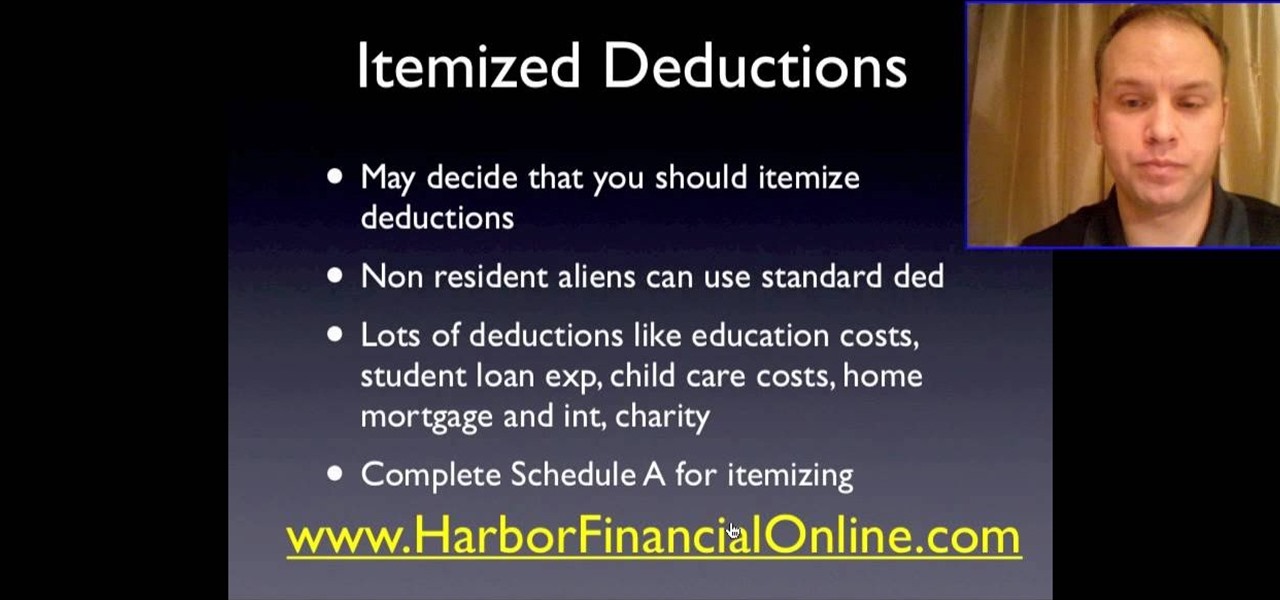

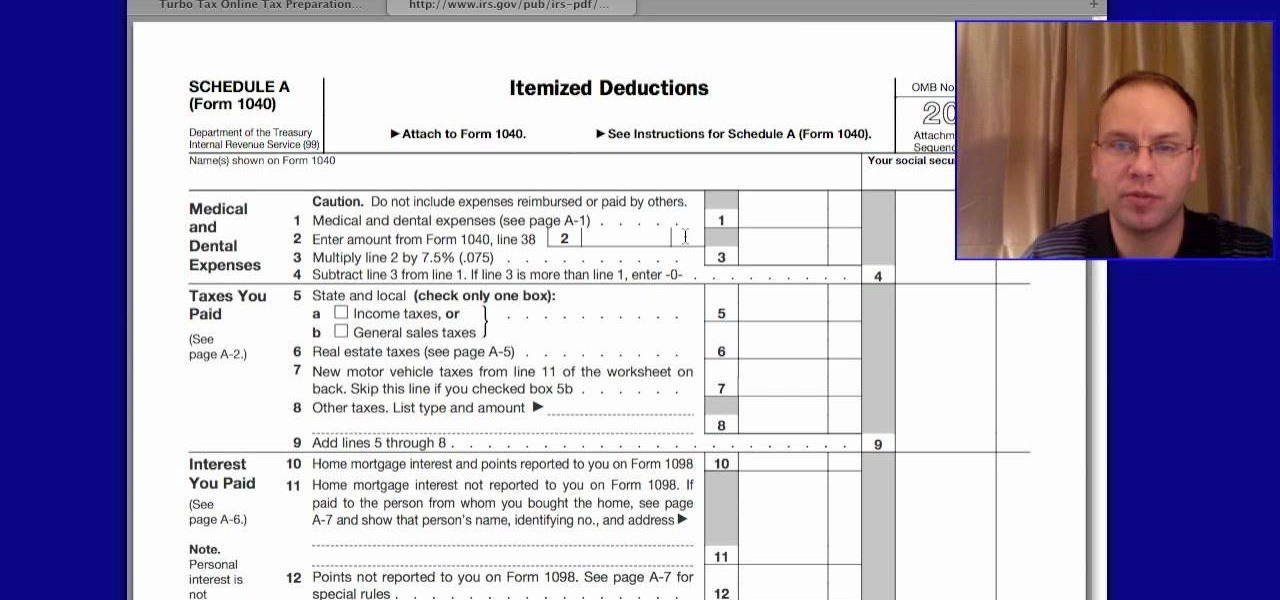

The world of taxes and filling out the 1040 form itself is pretty confusing, especially if you're unsure about the terms, "deductions" and "credits". In this video you will get a full walkthrough of how tax deductions work and how to fill out the Schedule A portion of the 1040 form for your federal income taxes.

If you have children who are still your dependents and have been living in your household for at least half of the year, and have their own social security number, you can actually get a major tax credit with a simple worksheet. In this video you will learn the requirements for the tax credit and also how to fill out the worksheet and calculate your credit.

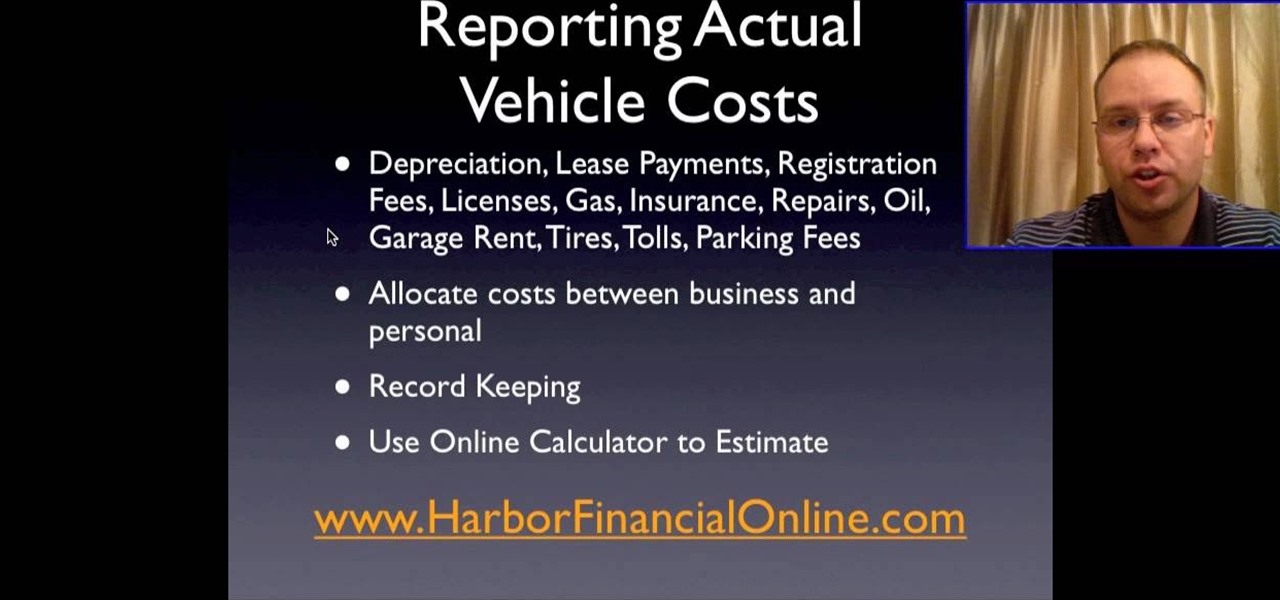

If you're driving a commercial vehicle or doing a lot of driving for a company, there are ways to claim deductions on your tax return for actual vehicle expenses. In this video you will learn how to calculate your standard mileage rates to determine how much you will be getting on your tax refund if your employer is not reimbursing you for gas or if you're running a small business.

Ever since high school, I've been preparing my own taxes. Each year it gets more and more complicated, which results in me filing later and later, avoiding it until I have the time or just can't wait any longer. I even resorted to using TurboTax online to help do some of the grunt work for me these past couple years, but that hasn't stopped me from being lazy about it. I have yet to file my 2010 taxes, but I will very soon. Tomorrow, in fact—before TurboTax raises their prices.

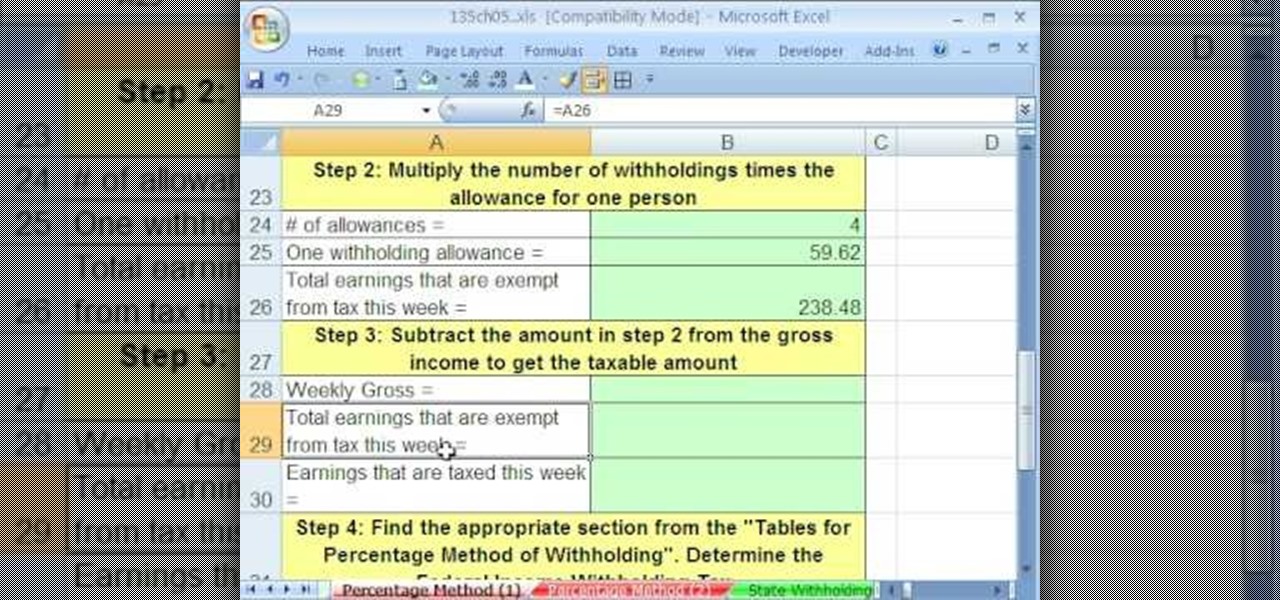

As you might guess, one of the domains in which Microsoft Excel really excels is business math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 42nd installment in his "Excel Business Math" series of free video lessons, you'll learn about the wage bracket and percentage methods for calculating federal income tax payroll deductions.

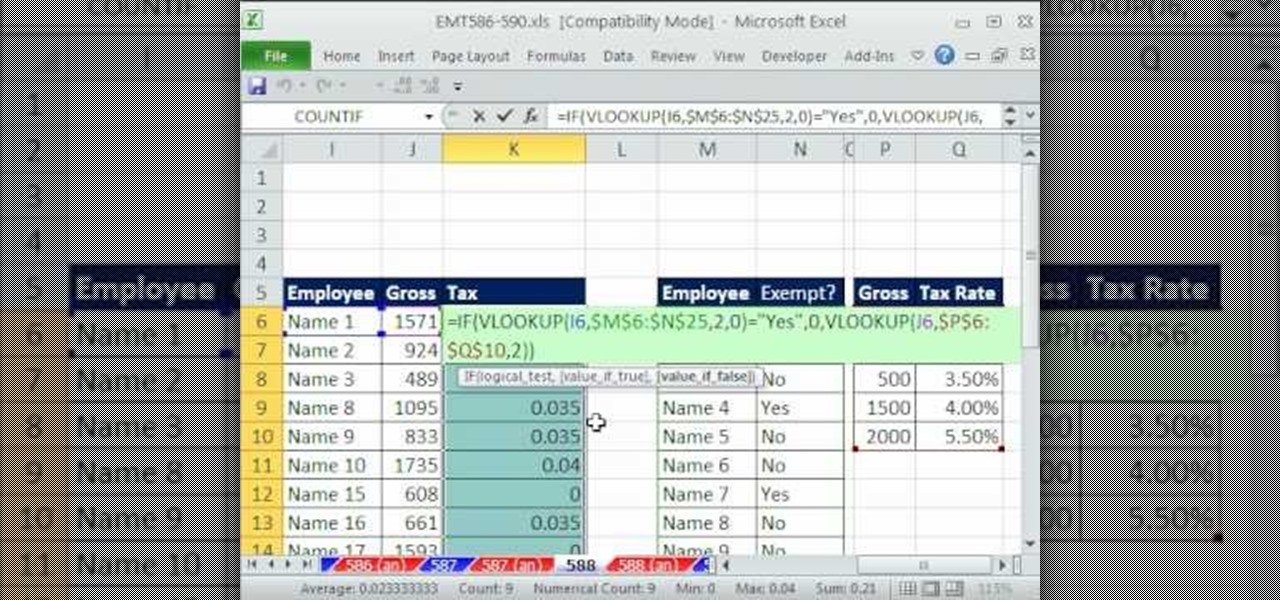

New to Microsoft Excel? Looking for a tip? How about a tip so mind-blowingly useful as to qualify as a magic trick? You're in luck. In this MS Excel tutorial from ExcelIsFun, the 588th installment in their series of digital spreadsheet magic tricks, you'll learn how to determine whether an employee is exempt from a tax using a VLOOKUP in an IF function, and if not use a second VLOOKUP lookup query to look in tax tables to look up and calculate the tax

This video is a useful ex-offender resource that will help people with felony convictions get employment by teaching them to properly put together a resume. A poorly written resume can hinder your employment.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 12th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate average and marginal tax rates with Excel.

Today's word is "chicanery". This is a noun which means trickery or the act of deceiving someone.

Today's word is "scrutinize". This is a verb which means to check and examine very closely.

In this video, Steven Chong teaches you about when to use the "functional" resume format. In this video you will be introduced to the "functional" resume format, and when to use it. The Functional Format Resume lists your employment history into sections. These sections highlight areas of skill and accomplishment. Reasons to use this type of format include: When you are overqualified. If you have gaps in your employment history. When you are going to a completely different industry. If you fo...

It wasn't too long ago that Uber threatened to fire star engineer Anthony Levandowski. Eleven days to be exact. If Levandowski didn't turn over the documentation he allegedly stole from Google's autonomous car division, Uber informed Levandowski that they would take "adverse employment action." Today, The New York Times reported the ride-sharing firm has delivered on that threat. In a memo sent to employees Tuesday morning, Uber announced Lewandowski's official departure from the company "eff...

If you're running a business and have employees, chances are you may have to write up a Employment Verification Letter. The tricky part is knowing what to put down on the letter itself. In this video you will learn what layout you will need and the information to put into the letter including: Company Letter Head, contact information, description of the employee's duties, ect.

Love Microsoft Excel? This clip contains a tip that just might induce you to. With this free video tutorial from ExcelIsFun, the 77th installment of his "YouTubers Love Excel" or YTLE series of free video MS Excel lessons, you'll learn how to do a complicated payroll formula when tax data must be retrieved from multiple tables. See how to use the INDEX, INDIRECT AND MATCH functions in one big formula to retrieve tax data from multiple tables on multiple sheets. Learn to love digital spreadshe...

With increasing wealth, leisure time, and opportunities for employment, more original art is available to the masses. But that's no excuse to act like a goon in a gallery. Going to take in and appreciate the art can be a fun way to pass the time, but make sure you're practicing good gallery etiquette. Watch this video tutorial and learn how to act at an art gallery.

The rhetorical skirmish over this question is the prelude for bargaining that’s likely to culminate after Election Day as President Barack Obama tries to persuade Congress to raise income tax rates on people with incomes over $200,000 and Republican try to keep the current tax rates in place at least for 2013.

Despite Ruling, Jack Lew Refuses to Call Health Care Mandate a Tax - ABC News.

Selling stuff at the local flea market sounds easy enough, but it isn't anything like having a yard sale. There's a lot more to it that just getting rid of your junk, and the biggest things are being licensed and having a sales tax number. Flea market vendor may not be your first career choice but, like many, you may find it’s a lucrative full-time job or a profitable and fun sideline.

If you saw my last tutorial on retiring early and wealthy, you now know how anyone can invest a small amount of money over the course of their life, and by exploiting compound interest, achieve an extremely comfortable and easy going retirement. In Part 2, we are going to dive into something a little more risky: Tax liens.

It looks like Chris Urmson has spent the six months since he left Google's Self Driving Car Project trying to build a get-rich-quick self-driving unicorn, along with Sterling Anderson, formerly with Tesla Motors. At least that is one of several scandalous accusations in a Tesla lawsuit aimed at the pair, and their secretive startup Aurora Innovation, LLC.

The drill demonstrated in this how-to video is so tough, you have to try it out in your swim-training. The marching soldier drill really works co-ordination and is very taxing on the legs; it also helps improve body positioning when under tremendous strain. Improve your backstroke form and technique by watching this video swimming tutorial.

Looking for fast cash with no questions asked? There are legitimate ways to get it, if you're willing to pay the consequences. You will need a credit card with unused credit, a tax refund, a car, a small loan company, a signature loan company, or a payday loan. Watch this video tutorial and learn how to get money quickly by finding a loan shark.

Often times your electricity bill is complicated and you'll see fees and taxes that you may have no idea about. This video will tell you everything you need to know about these taxes and fees.

Alphabet's moonshot factory, X (formerly "Google X"), is a secretive place, but it seems that when they are close to graduating a project, then they need to staff it up quickly. Watching for these job ads is one easy way to know they're close to budding off a baby.

Sow your wild oats! In this video, Jody Fath shares the expertise she gleaned from her eleven months backpacking around the world. Learn where to say, how to protect your things safe while traveling and methods for finding employment legally while abroad.

Uber's legal team may have finally sold their engineering golden boy down the river as their war with Waymo continues. Anthony Levandowski isn't your average sacrificial lamb either — given the alleged stealing and all that — but Uber seems set on distancing themselves from this whole fiasco as fast as they can.

If you've set up a way with the IRS to pay off your taxes, you may want to consider signing up for the new Online Payment Agreement. This simple method lets you pay from your home computer and you can even set up direct debit for even more convenience.

If you've made any donations to charity this year, there are several important rules about deducting charitable contributions on your tax return. Most importantly, the correct paperwork is needed to document the transaction for the deduction. Find out in this informative video from IRS.gov.

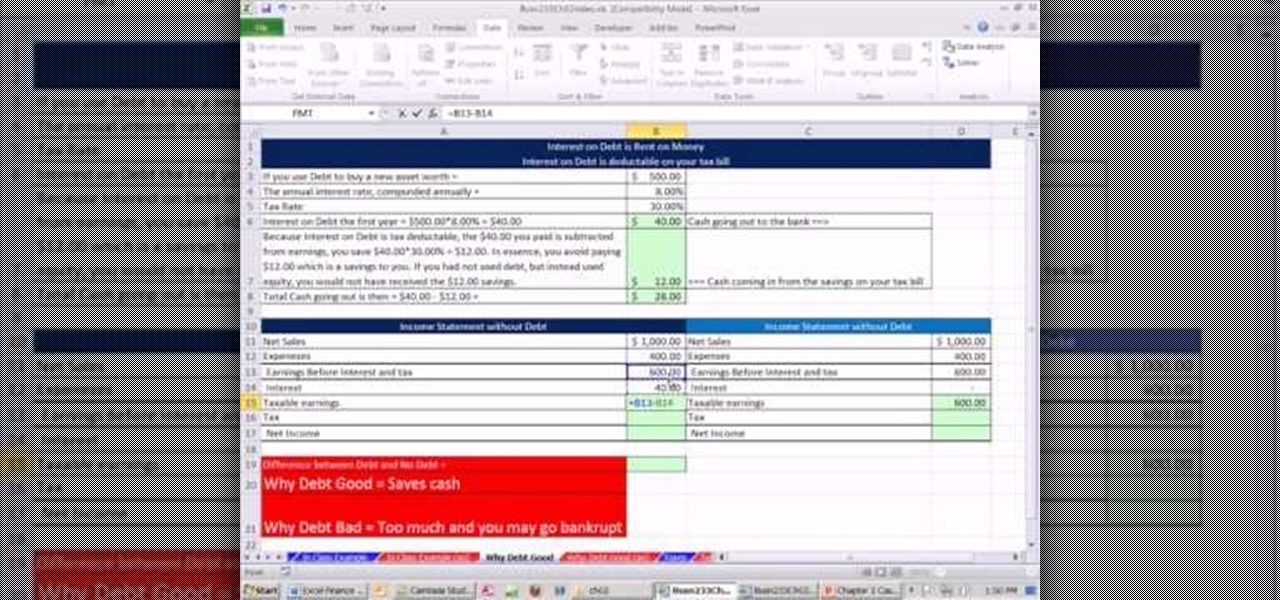

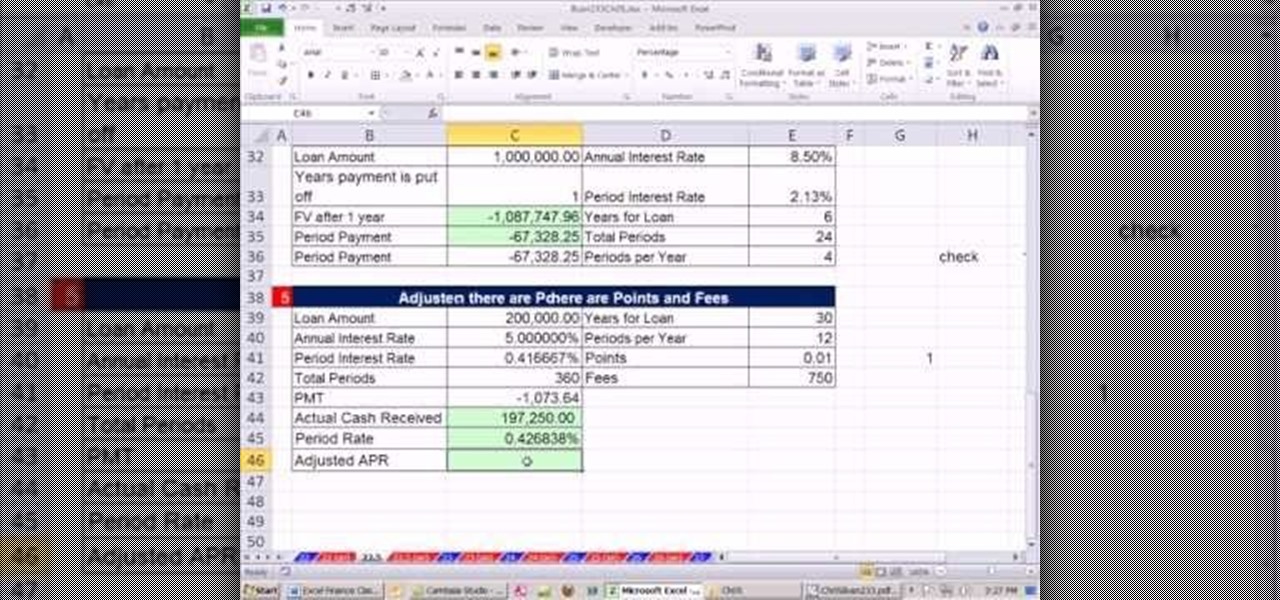

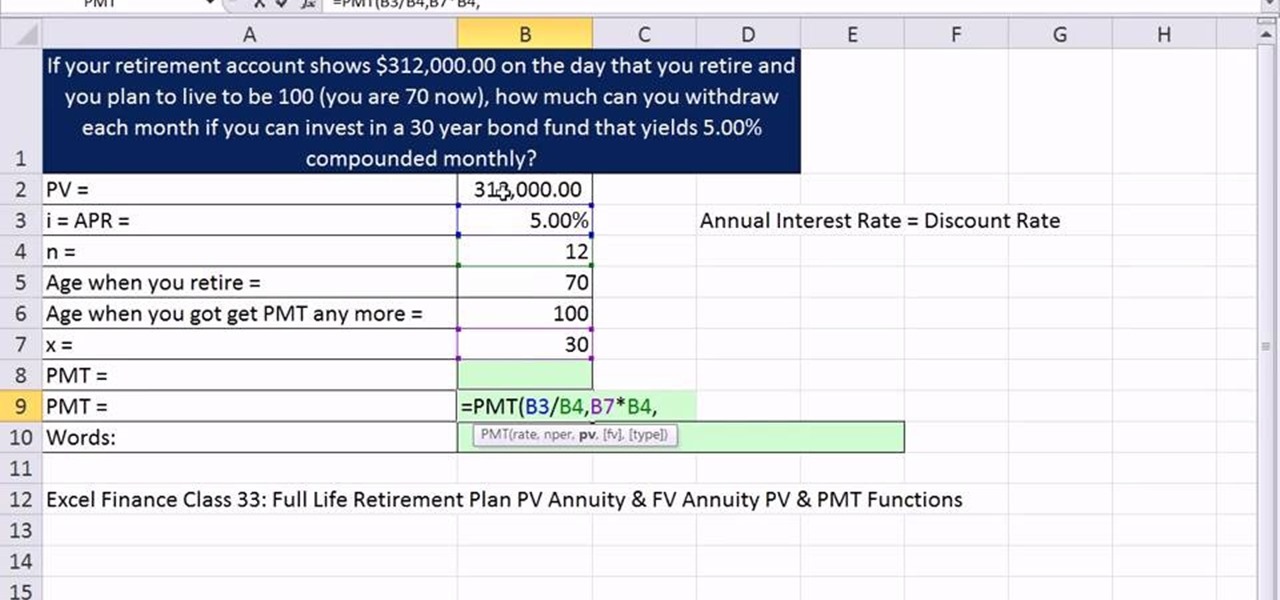

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 12th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate average and marginal tax rates with Excel.

As you might guess, one of the domains in which Microsoft Excel really excels is finance math. Brush up on the stuff for your next or current job with this how-to. In this tutorial from everyone's favorite digital spreadsheet guru, YouTube's ExcelIsFun, the 12th installment in his "Excel Finance Class" series of free video lessons, you'll learn how to calculate average and marginal tax rates with Excel.

Whether you're interested in learning Microsoft Excel from the bottom up or just looking to pick up a few tips and tricks, you've come to the right place. In this tutorial from everyone's favorite digital spreadsheet guru, ExcelIsFun, the 34th installment in his "Highline Excel Class" series of free video Excel lessons, you'll learn how to create a formula that will calculate the taxable earnings for a payroll period when there are ceilings (hurdles maximum) for taxable earnings (above which ...